Looking for some inspiration for ASX retail shares? Here are two I’m liking at the moment.

Baby Bunting

A common downfall of many retailers is that they often sell items that are discretionary in nature, meaning their success can be leveraged to underlying economic conditions. A good example might be an electronics retailer such as JB Hi-Fi Limited (ASX: JBH) or Harvey Norman Holdings Limited (ASX: HVN).

BBN share price

Baby Bunting Group Ltd (ASX: BBN) might be more defensive as baby-related products might be considered slightly less discretionary compared to other consumer products.

The company has around 59 physical stores and an online platform but plans to grow its store network to around 100 stores with a New Zealand expansion also recently confirmed.

Baby Bunting’s shares are relatively expensive to the industry average of other retailers, but it’s because the company is continually reinvesting back into the business to further support its growth strategy.

As the business continues to scale to its full capacity of over 100 stores, management believes more operational efficiencies and operating leverage will be achieved.

For more reading on Baby Bunting shares, click here to read: Why I think Baby Bunting (ASX: BBN) shares might be a fantastic buy and hold opportunity.

Kogan

After Kogan.com Ltd’s (ASX: KGN) shares have fallen over 35% in the last month, they’re now trading at roughly 23x FY21 forecasted earnings. At these levels, the valuation appears to be much more reasonable for a high-quality company.

It’s important to note what has caused Kogan’s shares to trend downwards recently.

Rather than operational underperformance, Kogan’s shares have been affected by the recent rotation out of growth into value stocks in light of rising bond yields. It doesn’t affect too many of the underlying fundamentals, so I’m happy to look past this for the moment.

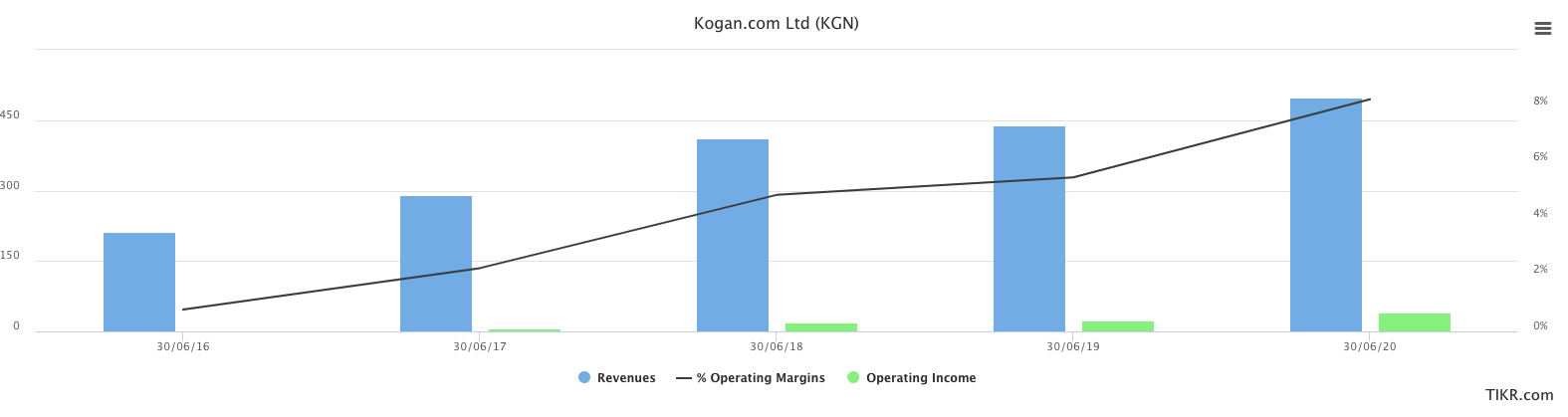

Kogan’s growth over the last several years is easy to appreciate when it’s represented on the below chart. It has many things I’d typically look for in a quality company, including rising revenues and expanding operating margins as the business achieves some scale benefits.

Kogan recently acquired New Zealand-based e-commerce retailer Mighty Ape in a $122 million deal.

The two businesses are fairly similar in terms of their product offering and target market. Due to these similarities, it seems likely Kogan will be able to achieve additional synergy benefits as it can combine back-office functions and private label sourcing.

To read more about Kogan shares, click here to read: Is it finally time to invest in Kogan (ASX: KGN)?