The information technology sector was mostly responsible for bringing down the broader ASX200 (ASX: XJO) 0.4% lower yesterday.

Among the hardest hit was software company Xero Limited (ASX: XRO), down 3.36%, Afterpay Ltd (ASX: APT), falling 4.16% and Megaport Ltd (ASX: MP1), tumbling just under 6%.

Yesterday’s dip in the tech sector comes in response to falling US futures, rising bond yields and a recently announced three-day lockdown in Brisbane, which sent travel stocks like Webjet Limited (ASX: WEB) and Flight Centre Travel Group Ltd (ASX: FLT) into negative territory.

Here are 3 ASX tech shares with strong fundamentals that are trading at much more attractive valuations.

Jumbo Interactive

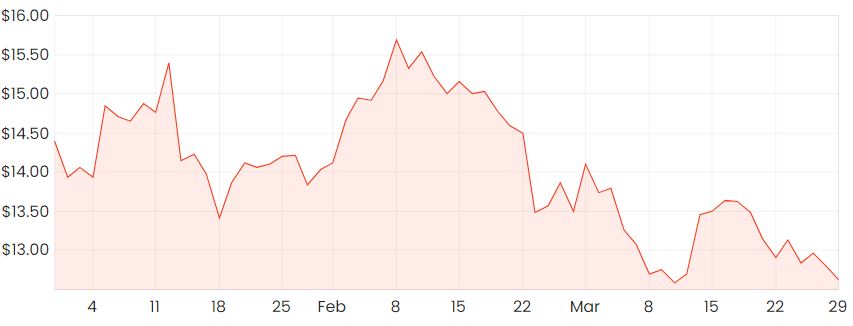

The recent technology sell-off has seen shares in Jumbo Interactive Ltd (ASX: JIN) pullback around 20% since its highs last month.

JIN share price

Jumbo operates through its flagship platform Oz Lotteries – an official retailer of Australian lottery tickets that’s been running over the last 20 years.

More recently, the company has become slightly more tech-oriented through the development of its Powered by Jumbo (PBJ) platform. PBJ is a Software-as-a-service (SaaS) offering that allows other lottery ticker retailers to adopt its software model for their own lottery ticket retailing.

Jumbo already has an established ticket retailing platform being used here in Australia, but it’s currently embarking on its international expansion and has won some notable clients recently including the St Helena Hospice in the UK.

While the growth story is still in fairly early stages, I think Jumbo would be able to scale quite well thanks to its capital-light business model typical of many SaaS businesses.

Additionally, Jumbo’s success may be further boosted in years to come through the accelerated adoption of online ticket retailing as a result of COVID-19.

Provided jumbo passes your own ethical filters, it might be worth taking a further look at. For more reading on Jumbo, click here to read: Are Jumbo Interactive (ASX: JIN) shares about to pop?

Xero

Cloud-based accounting software company Xero is quite often among some of the hardest hit when the broader tech sector takes a beating.

Xero is the exact same company it was at the start of the year, but its shares are now trading at a 20% discount.

The recent dip has come despite the company announcing two exciting acquisitions within the last month, which could provide the company with some significant additional growth opportunities.

Xero announced at the start of this month it would acquire a cloud-based employee platform called Planday in a $285 million deal.

Planday is based in Denmark but operates in Norway, Sweden, the UK, Germany and France and is supported in 14 languages. Planday can be used by businesses to control their labour costs by adjusting staffing levels to match the appropriate trading conditions.

Just recently, Xero revealed it had acquired an e-invoicing platform called Tickstar, which is based in Sweeden.

As my colleague, Raymond Jang pointed out in his recent article, there are some structural factors driving the adoption of e-invoicing within organisations, which Xero is likely to capitalise on.

According to Goldman Sachs’s research, Xero’s Planday acquisition is expected to generate an additional NZ$30 million per year.

However, it seems the larger objective for Xero is the continued expansion of if its app ecosystem in addition to entering new geographic markets, which provides the opportunity to cross-sell products.

To read more on Xero, click here to read: Down 28% in 3 months: Are Xero (ASX: XRO) shares in bargain territory?

Altium

Printed circuit board (PCB) software provider Altium Limited (ASX: ALU) took a fairly large hit yesterday, shedding 3.5% off its valuation. After hitting highs of around $40 per share last year, Altium’s valuation is looking much more attractive around its current $26 mark.

ALU share price

It is worth noting that Altium’s underwhelming HY21 results was a contributing factor to its recent downtrend, but at this stage, it appears these challenges are transitory and aren’t more of a structural problem.

Altium has many of the characteristics I’d look for in a quality investment. It has sticky customers due to the complex nature of PCB design, a scalable business model typical of a SaaS business, and some potential network effects that could be unlocked through its cloud-based Altium 365 platform.

I think there’s some potential upside for Altium as it continues to execute its Altium 365 growth strategy and through its transition from a perpetual software licence model to a more flexible SaaS model.

For further reading on Altium’s shares, click here to read: Will tech stocks crash in 2021? Here’s 1 ASX share I’d buy if they did.

I’d also recommend signing up for a free Rask account to access our stock reports.