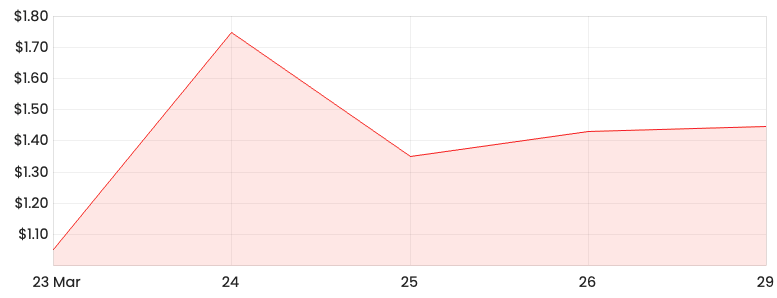

The euphoria over the Airtasker Ltd (ASX: ART) listing seems to have dropped off as its share price hovers around the $1.45 mark. So, how would you go about measuring Airtasker’s future growth potential?

One key factor I would dive into is Airtasker’s competitors.

ART share price

Who is Airtasker up against?

It seems like Airtasker is striving to become the Amazon of the online labour marketplace as it services all possible categories. In Australia, Airtasker’s main competitors are Freelancer Ltd (ASX: FLN), Upwork Inc, and Fiverr International Ltd.

These three players have a strong global presence but what makes Airtasker different?

Limitless categories

Airtasker’s categories know no boundaries as users can even request a ‘tasker’ to help remove spiders or plan a romantic evening. That’s right, if you don’t have the time and effort to do something, a ‘tasker’ can help you do it.

The aforementioned three big players are focused on providing remote services; clerical and data entry, creative and multimedia, writing and translation, professionals services, and sales and marketing. On top of remote services, Airtasker also provides local services such as home repair and domestic services etc.

According to a report on digital platform work in Australia prepared by the Victorian Department of Premier and Cabinet in 2019, Airtasker was the most commonly used platform by platform workers in the previous 12 months.

The report notes 34.8% of platform workers had used Airtasker, 11.8% for Freelancer, Upwork accounted for 6.2% and Fiverr came in at 6.0%.

This is an impressive number given that Airtasker’s fellow Aussie listed competitor, Freelancer has been around since 2013.

Revenue model

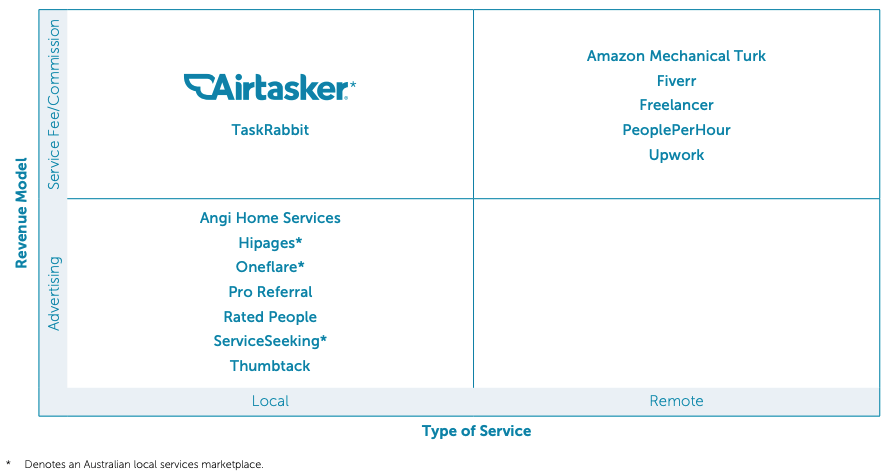

Airtasker and US-based competitor, TaskRabbit, are the only online labour marketplaces that offer local services through a service fee/commission revenue model. The revenue model and type of service provided for the competitive landscape is shown below.

Source: ART prospectus

As you can see, there are a lot of competitors in the digital platform space but Airtasker’s key differentiators lie in its limitless categories and revenue model for local services.

Airtasker to reach greater heights?

Users tend to gravitate towards marketplaces with the biggest number of providers. So in Airtasker’s case, I think it’s important to monitor the number of ‘taskers’, which will likely drive the number of users.

If Airtasker can continue to attract more platform workers and scale across more global markets, this could enable Airtasker to pass on potential cost savings to users and ‘taskers’.

It seems Aussie platform workers prefer Airtasker’s revenue model and platform, which is encouraging to see. However, replicating this success in overseas markets is a different kettle of fish.

In saying this, Airtasker is capitalising on untapped categories, which could become a key competitive advantage.

Investors should also consider the loophole in Airtasker’s business model outlined by my colleague, Patrick Melville. Also, you can read more about Airtasker’s brand and some data points to monitor in my article last week.