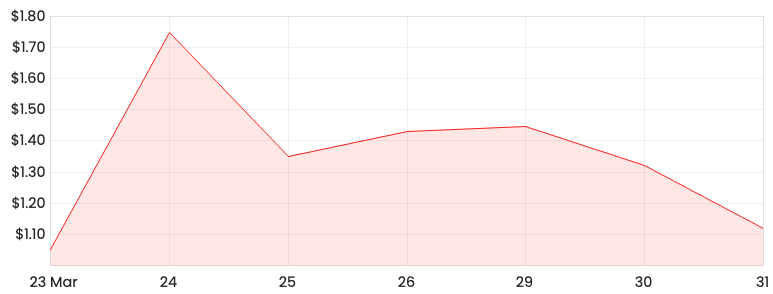

The Airtasker Ltd (ASX: ART) share price has continued to descend towards its opening price. In these circumstances, I try and focus on the business’s long-term growth potential.

One important area to dig into is Airtasker’s total addressable market (TAM).

ART share price

What is Airtasker’s TAM?

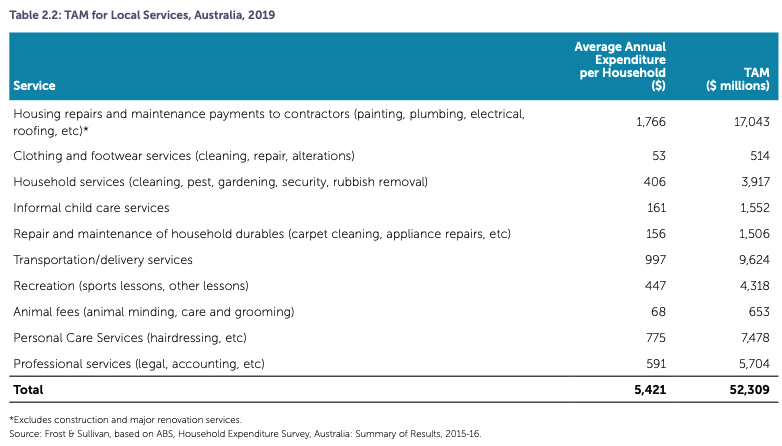

Airtasker has used the 2015-16 Household Expenditure Survey (HES) published by the Australian Bureau of Statistics (ABS) to estimate the TAM for local services in Australia. This is the most recent HES published by the ABS with the previous one being published in 2009-10.

The 2015-16 HES provides the weekly average household expenditure for 2016 on local services, which has actually increased at a compound annual growth rate (CAGR) of 5.2% between 2010 and 2016. Airtasker has applied this CAGR to the 2016 figures to estimate 2019 amounts.

This estimated weekly average household expenditure for 2019 per service is then annualised and multiplied by the total number of households in Australia to arrive at the total expenditure for each service. This is illustrated below.

As you can see, the table doesn’t include construction and major renovation services.

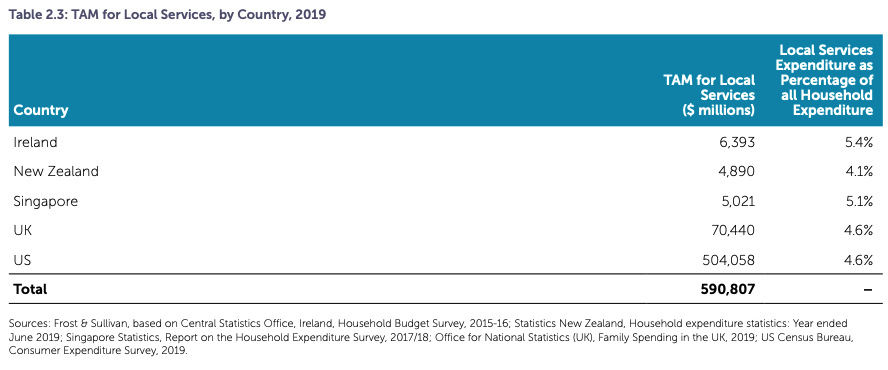

In terms of other countries, Airtasker has used the same methodology to estimate local services expenditure. The household expenditure for other countries is also based on respective household expenditure surveys as shown below.

As you can gather, the TAM for Airtasker and digital labour platforms is massive.

Why is the TAM important?

As part of the Rask investment philosophy, it’s important to find businesses that operate in a structurally growing and increasingly important sector, market or geography.

As you can see from above, average household expenditure has been increasing over the last decade. Household expenditure on local services is the key source of growth for digital platform workers, and ultimately Airtasker’s revenue.

The TAM is particularly important for Airtasker since its business model relies on the volume of tasks and new users. Also, as my colleague, Patrick Melville outlines in his take on Airtasker and in my previous article, the frequency of repeat usage has remained consistently low.

Final thoughts

The most important thing to note is that Airtasker’s TAM appears to be growing and it’s a matter of Airtasker being able to capture more market share.

Airtasker appears to be the dominant player in Australia as outlined in my earlier article on its competition. So, if Airtasker can build on its brand and continue to expand new categories of services, its TAM will likely continue to grow.

There is also a growing shift towards using mobile apps to get things done, which isn’t accounted for in the calculation of the TAM. I think there will be a growing trend of people adopting one marketplace to seek service providers, similar to how a lot of people have used either eBay (NASDAQ: EBAY) or Amazon.com Inc. (NASDAQ: AMZN) for online purchases.

In saying this, eBay and Amazon have been able to build strong brands and scale effectively. I think using web traffic and social media data points will be key to monitor its progress in capturing market share and ultimately the power of Airtasker’s brand.

If you are interested in Airtasker’s key financial metrics, my colleague, Jaz Harrison recently provided a great overview.