On Wednesday, the S&P/ASX 200 (INDEXASX: XJO) traded modestly higher. The Westpac Banking Corp (ASX: WBC) share price and EML Payments Ltd (ASX: EML) share price are in focus today.

Interestingly, new car sales jumped a stunning 22% in March, following a similar jump in used car sales during 2020. Consumers are clearly turning once again to domestic travel and upgrading their cars instead of taking overseas trips.

Despite the result, AP Eagers (ASX: APE) which controls 10% of the market was weak. APE shares fell 0.6%.

Prepaid gift card provider EML Payments Ltd (ASX: EML) lead the market on Wednesday. The EML share price jumped 5.5% after announcing its entry into the Open Banking market via the EUR$70 million acquisition of Sentenial in Europe.

The technology-driven company continues to pivot to seek alternative opportunities that leverage its data capabilities.

EML share price chart – 5 years

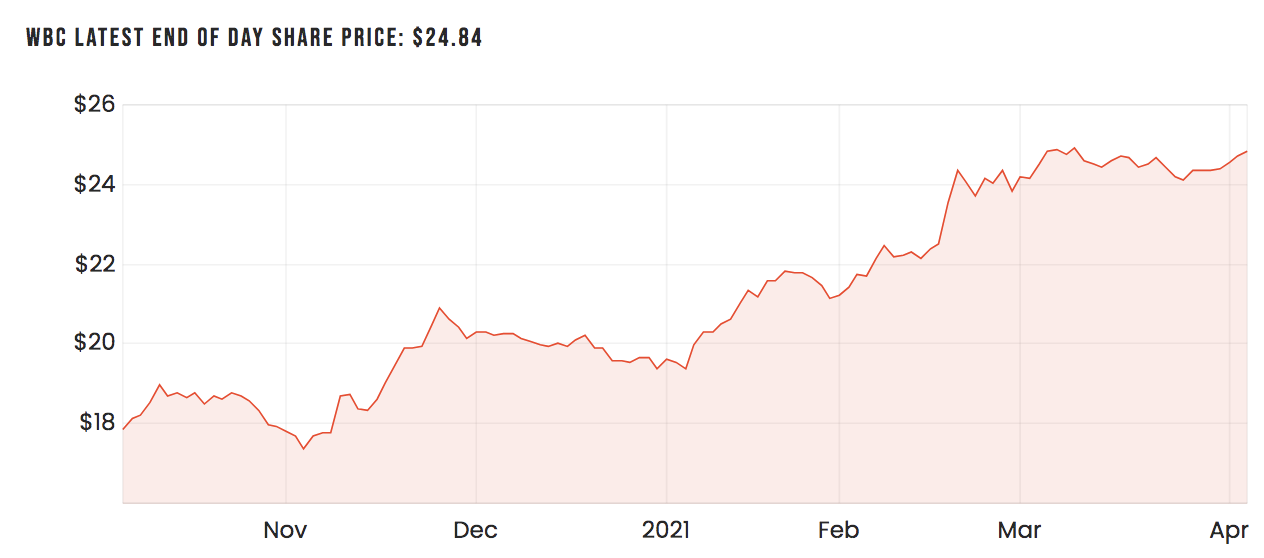

Westpac Banking Corp (ASX: WBC) looks set to make a tidy profit via its venture capital arm reinventure, with investee company Coinbase set to list on the Nasdaq next week.

WBC share price – 6 months

The Coinbase platform for trading cryptocurrencies and other digital assets reported a US$730 million first-quarter profit, double the full-year profit in 2020, as interest in the sector spiked. The Coinbase platform now has 56 million verified users and expected revenue to hit US$1.8 billion.

Get more WBC share price research.