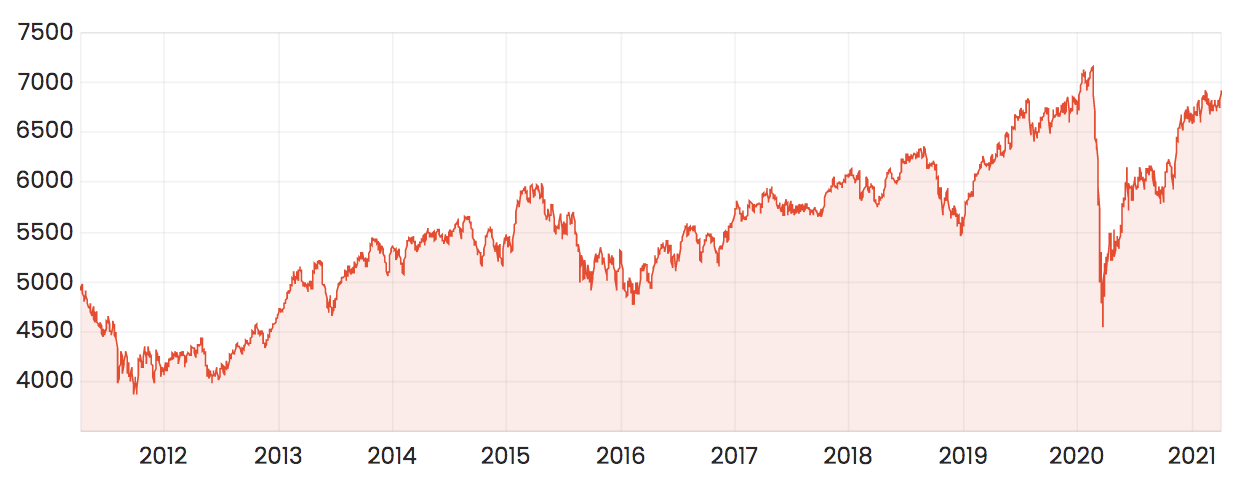

The S&P/ASX 200 (ASX: XJO) and All Ordinaries (INDEXASX: XAO) finished another 0.6% higher on Wednesday, reaching the highest point since February last year but still some way off the all-time high of 7,199 points. The ASX 200 price currently sits at 6,928.

ASX 200 share price

Once again it was the energy and materials sectors boosting the market as a flood of more positive economic news from car sales to infrastructure spending and IMF growth upgrades force investors into the market.

The energy sector finished 1.4% higher with Origin Energy (ASX: ORG) leading the way, with the ORG share price rising 2.4%, as a key beneficiary of a return to normal operating conditions and most importantly the flow-through of higher electricity prices.

The lithium sector has begun to recover after some profit-taking, boosted by Biden’s ongoing rhetoric around the ‘green infrastructure revolution’. The Pilbara Minerals (ASX: PLS) share price added 6.4% alone.

The building products sector was meaningfully lower, led by the AdBri (ASX: ABC) share price was down 5% amid reports that a lack of skilled labour is impacting on the ability for tradies to deliver on the Home Builder credits offered by the government.

According to the Sydney Futures Exchange, the ASX 200 is expected to open up 0.3% on Thursday. Shares to watch include Westpac Banking Corp (ASX: WBC).