Look back five years and study the S&P/ASX 200 (INDEXASX: XJO), which is made up of between 30% and 50% from four mature banks, two supermarkets and three resources companies, and you might be impressed by the returns.

However, if you look at the performance of the Xero Limited (ASX: XRO) share price, Afterpay Ltd (ASX: APT) share price and Pushpay Holdings Ltd (ASX: PPH) share price — your socks might come flying off.

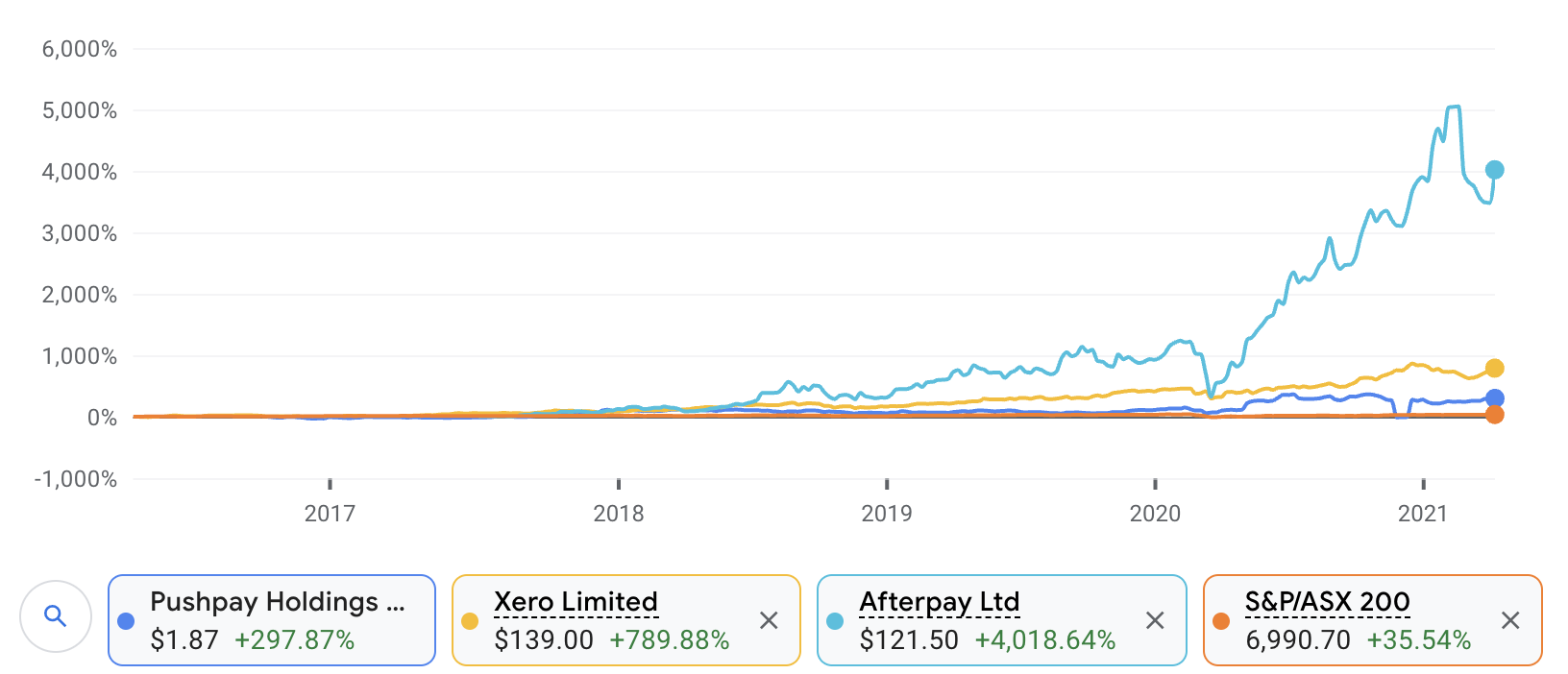

XRO, PPH & APT share price v ASX 200 (ASX: XJO)

As you can see in the chart above, over the past five years the returns from these three technology companies have been immense.

Afterpay, following its merger with Touch Corp and US expansion, is up a huge 40x or 4,000%. Even “sleepy” Kiwi church donation software provider Pushpay, a stock I own, is up nearly 300% in five years. Note: Pushpay split its stock 1-for-4 last year. Meaning shareholders got four new shares for every one they already held.

Finally, Xero — one of the world’s two leading accounting software companies alongside Intuit Inc (NASDAQ: INTU) — is up a hefty 790% in five years, having conquered the Kiwi/NZ market, the Aussie market, and most recently the UK. It’s now a $20 billion company!

What do XRO, PPH & APT shares have in common?

In the latest episode of The Australian Investors Podcast, I was talking small-cap ASX shares with Mark Tobin and Andrew Page. In the conversation, Mark, a former accountant, made note of Xero and something he read from Peter Thiel. You can listen to the podcast on Rask Media.

Basically, for a company to become a rapid growth story, such as when the APT share price took flight, its product or service needs to be either 10x better than the competitor’s products or 10x cheaper. As Mark noted in our chat, Xero’s accounting software was (and some might say still is) 10x better than MYOB, Reckon and Sage (UK) — and even Quickbooks by Intuit.

Afterpay’s product, used correctly, also seems to be 10x better than traditional credit services like credit cards or payday loans.

Pushpay’s church donation software, which enables churchgoers primarily in the USA to donate/tithe online once off or regularly, is also a lot better for the churches which receive the money and their followers. Maybe not 10x better than a tray being passed around on a Sunday but close to it!

Of course, following this one ‘factor’ alone does not mean you’ll be a great investor — some great companies have shares that are way overpriced. Think Microsoft in 1999.

Buy, Hold or Sell

All of my valuations and share recommendations are reserved for our loyal and passionate members inside Rask Invest. However, what I can say is that one of the first things you or any investor should do when buying companies for the long run is try to understand the product and why it’s a good business. Why customers use the service. Why the product is better and what the customers say. Do that and your investing will become so much easier.

Again, it’s only the first thing the Rask team thinks about, in a long list of important items to consider when investing in companies, but it’s a good thing for every investor to do before buying ASX growth shares. Don’t take management’s word for it, experience the product yourself.

If you want to get one of my (free) stock reports, join our free mailing list by using the links below and we’ll email you the report. Thanks for reading.