The Afterpay Ltd (ASX: APT) share price has raced higher this month after almost falling below the $100 mark in March.

Earlier in the month, Afterpay released the latest instalment of the Next Gen Index, an economic series on consumer spending.

The results were produced by consulting firm AlphaBeta, a subsidiary of global powerhouse Accenture. Here are a few of the key insights.

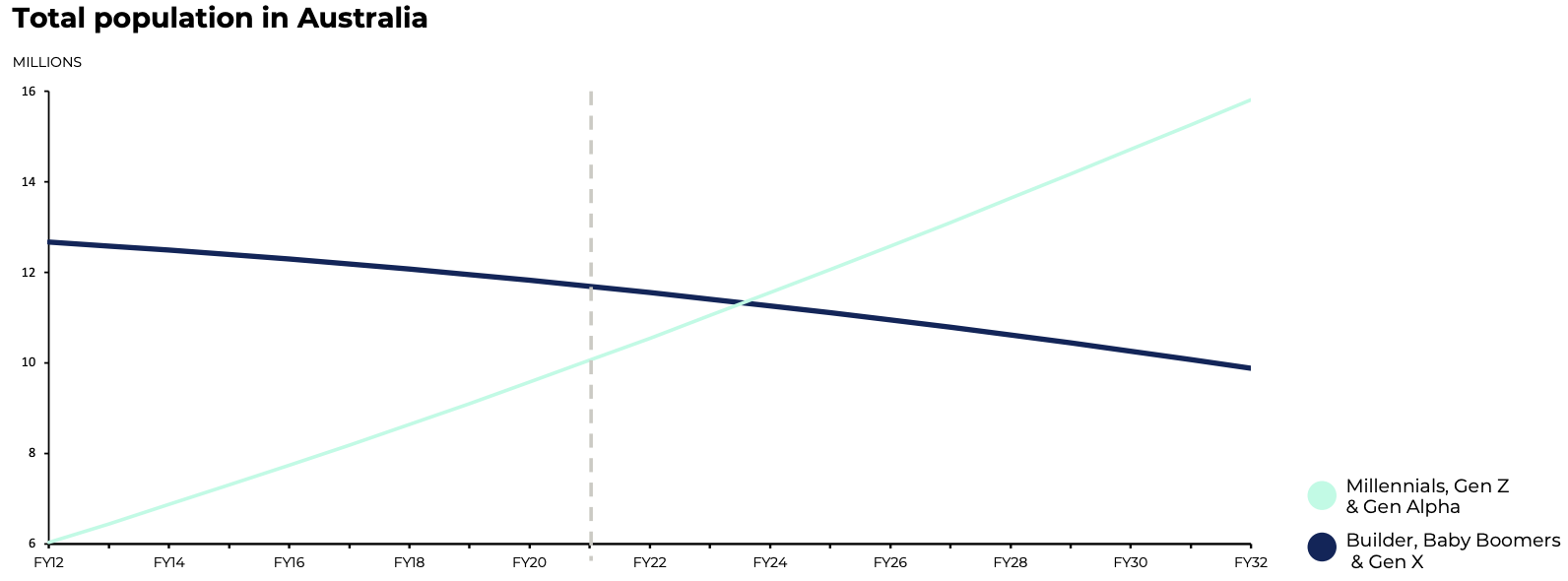

Changing of the guard

According to the report, the population of millennials, Gen Z and Gen Alpha will outnumber older generations by FY24.

Gen Z and Millennials currently account for 36% of the total retail spend in Australia. This is set to grow to 48% by 2030, as more of the Gen Z population (currently aged 9-24) enter the workforce.

Research conducted by Macquarie Group Ltd (ASX: MQG) has also found that millennials will earn two out of every three dollars in Australia by 2030.

What’s more, these younger generations are driving the change in global spending habits away from traditional credit products.

And it just so happens that around 70% of Afterpay’s customers are millennials.

With a product that resonates with the young consumer, Afterpay has a strong relationship with those who are set to become the biggest earners (and naturally, spenders) of tomorrow.

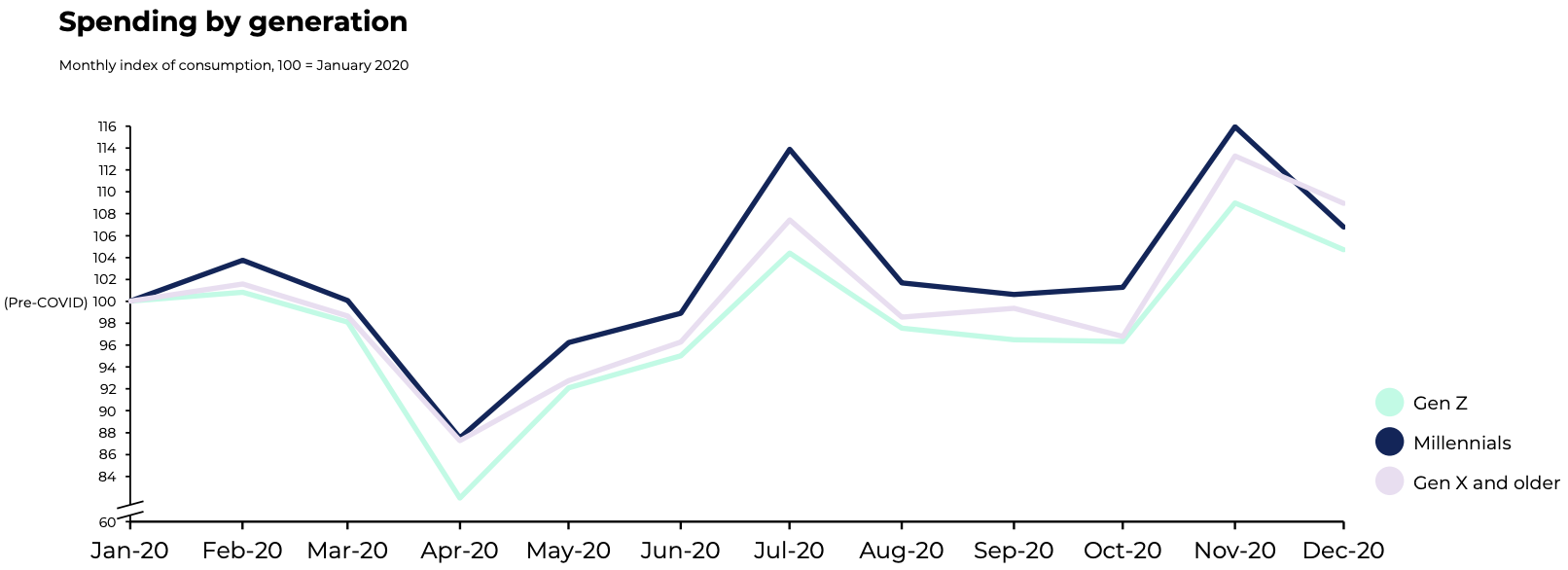

Spending bounces back

According to the report, spending by millennials and Gen Z has recovered, and is now 7% and 5% above pre-COVID levels.

Millennials were the most likely to push funds back into the economy, with spending increasing to 14% above pre-COVID levels in July.

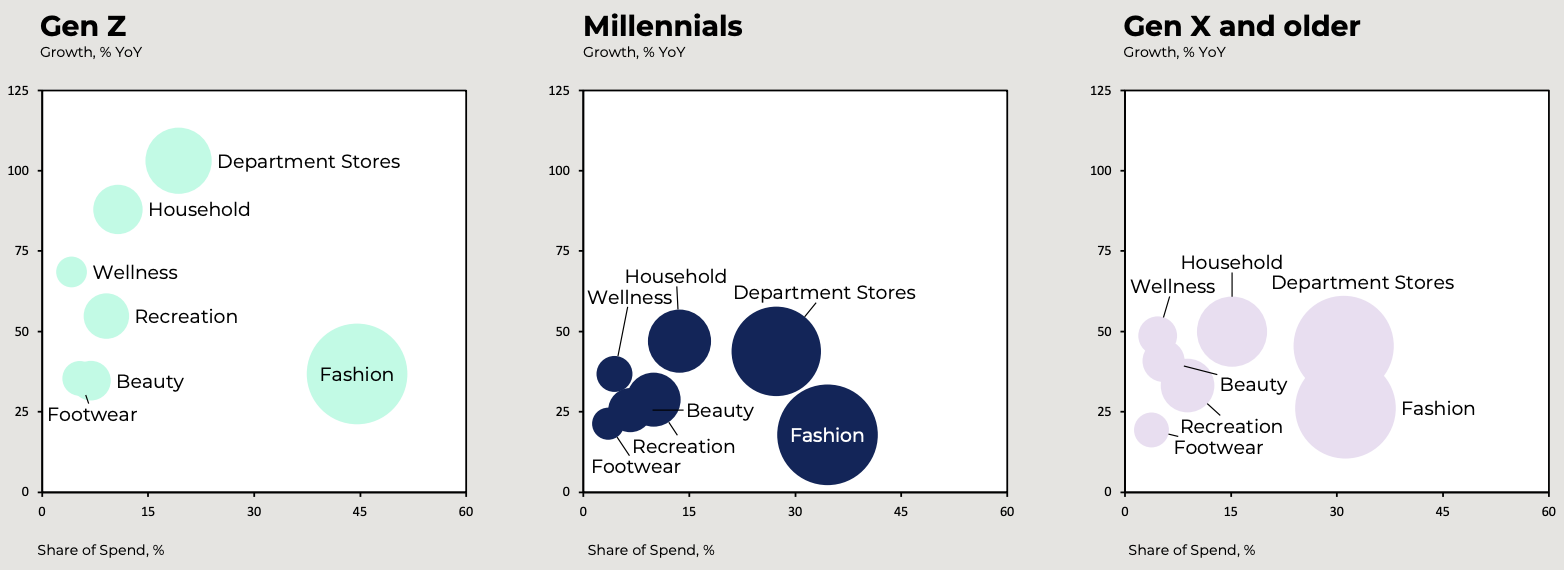

Spending trends by generation

For millennials and Gen Z using Afterpay, the top growing spending categories are household and department stores.

This is evidenced in the charts below, in which the Y-axis (left hand side) represents year-on-year growth rates, while the X-axis represents the percentage share of spend.

Fashion reigns supreme across all generations, being the most popular category for Afterpay users in terms of dollars spent.

Now what?

For more reading on Afterpay, check out these articles:

Or, check out our in-depth 7,500-word buy now, pay later industry report.