The CSL Limited (ASX: CSL) share price has slightly dropped due to negative news surrounding the AstraZeneca vaccine. What does this mean for the CSL share price?

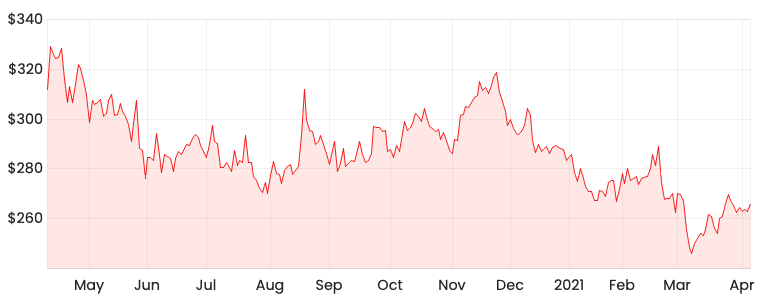

CSL share price

CSL may have overpromised and under-delivered

Australia’s health department and CSL initially set a goal of producing a million AstraZeneca doses a week by the end of March 2021.

However, the government advises only 700,000 doses of the vaccine have been delivered.

Brendan Murphy, the Secretary of the Department of Health attributes this to two reasons.

Firstly, Brendan Murphy advises there has been a delay in the time taken for the batch release process due to several international clearance processes.

Secondly, he advises there is still a significant improvement to be made on the fill and finish line process.

CSL remains committed to achieving this goal and Health Minister, Greg Hunt advises CSL will hit the original goal in the very near future.

Concerns over the AstraZeneca vaccine

In September 2020, the government signed a deal for 3.8 million doses of the AstraZeneca vaccine with a further 50 million doses to be made by CSL in 2021.

The European Medicines Agency (EMA) discovered that the AstraZeneca vaccine could possibly cause rare blood clotting issues in adults.

In the UK, the vaccine advisory board swiftly responded by advising all people under the age of 30 would be offered alternative vaccines like Pfizer and Moderna.

Overnight, the Australian government announced changes upon receiving expert advice that AstraZeneca was not recommended for people younger than 50. The Australian Technical Advisory Group on Immunisation noted the use of the Pfizer drug is preferable for adults under 50 due to the increased risk of complications.

My takeaway

All of this seems to be bad news at face value but I think a lot of people are getting caught up with concerns surrounding the vaccine rather than focusing on CSL’s core business.

CSL generates a majority of its revenue from blood plasma vaccines and antivenoms, providing relief for potentially life-threatening medical conditions.

It appears CSL has been struggling to meet its initial production target, which may mean the business is using more resources than expected. So, investors should keep an eye on whether operating costs as a percentage of revenue is increasing.

Gross margins for CSL has been growing steadily, so any significant drop may be attributed to the vaccine revenue segment.

If you are interested in other ASX growth ideas, I suggest getting a free Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.