The Novatti Group Ltd (ASX: NOV) share price is charging higher today after the company provided an update regarding its recently-signed partnership with Ripple.

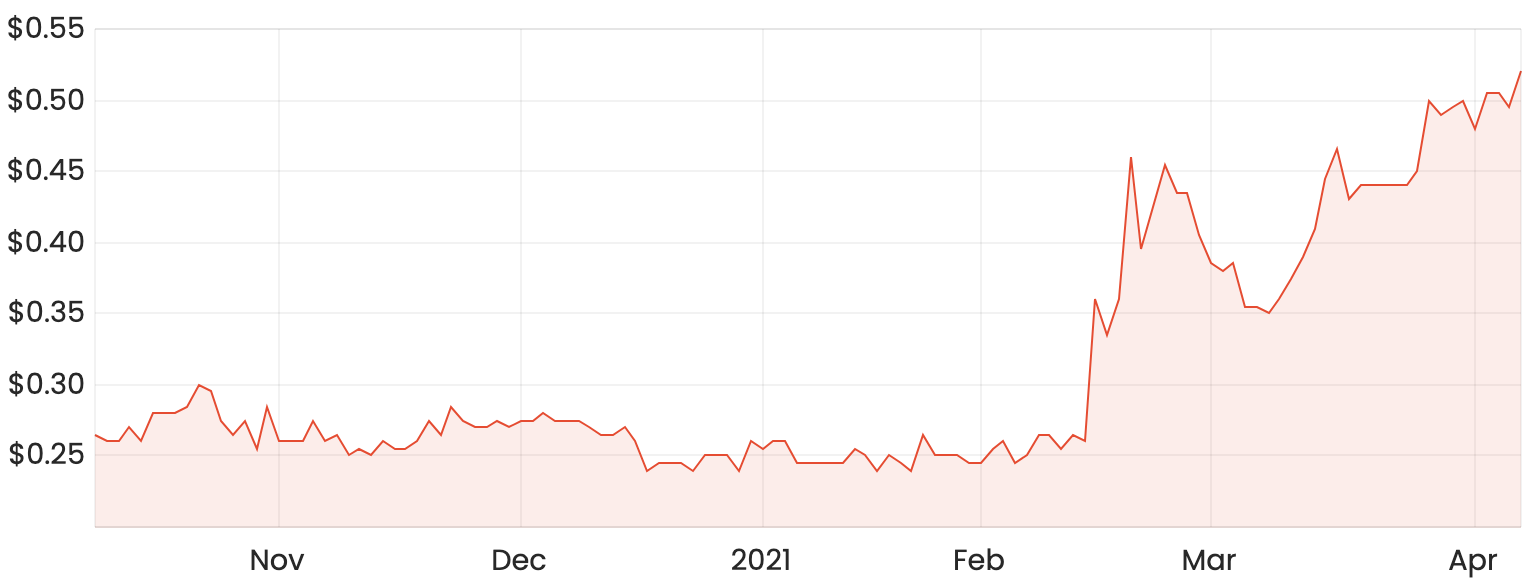

In late afternoon trade, the Novatti share price has jumped 5%, meaning shares have now doubled since the start of the year.

Novatti share price chart

For those unfamiliar, Novatti is in the business of digital banking and payments. The company has a number of transaction processing services under its banner.

This includes ChinaPayments (a bill payment service), Flexepin (an open-loop cash voucher service), Flexewallet (for remittance and compliance services) and VascoPay (prepaid cards).

Who is Ripple?

Ripple is disrupting the global payments industry through RippleNet, its decentralised, global financial network.

Through this network, Ripple provides its partners with the ability to process payments instantly, as well as access to emerging capabilities, such as blockchain.

Novatti announced a partnership with Ripple in December 2020, with the aim of initially targeting cross-border transactions between Australia and the South East Asia region.

Through the partnership, Novatti’s customers will gain access to RippleNet, its capabilities and the hundreds of financial institutions that Ripple currently works with, which includes American Express.

Ripple partnership goes live in the Philippines

This morning, Novatti announced that its partnership with Ripple is now live, with revenue-generating transactions taking place.

The company stated the partnership is delivering new customers, with Novatti now partnering with iRemit, the Australian subsidiary of one of the largest remittance service providers in the Philippines.

The company expects this deal with iRemit alone to result in several thousand transactions a month being processed by Novatti through RippleNet. However, Novatti noted revenue from this partnership is dependent on the take-up of these services.

Commenting on the progress, Novatti’s managing director, Peter Cook, said:

“We are delighted to see this partnership delivering for both Novatti and Ripple in such a short period of time. The partnership with Ripple not only provides Novatti’s customers with access to new, innovative payment solutions, it also highlights how Novatti’s partnerships translate into revenue.”

The company also noted that discussions are underway to expand this service to new financial services clients in South East Asia.