The CSL Limited (ASX: CSL) share price could be a long-term opportunity for investors.

Why could the CSL share price be worth thinking about?

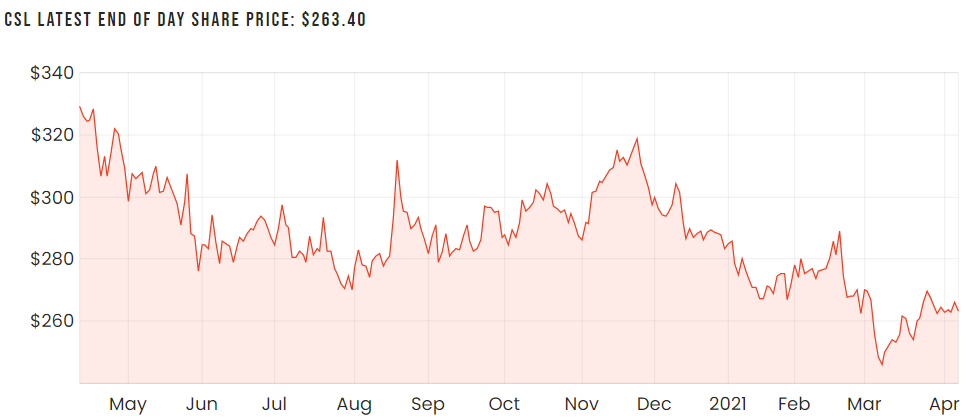

One of the most interesting aspects things looking at CSL at the moment, is that the shares are down 19% over the last year. That’s despite many other ASX shares actually being a fair bit higher than where they just after the worst point of the COVID-19 crash. The value on offer for shareholders is better now than a year ago.

Part of the possible explanation for the decline does make sense – its earnings are reported in US dollars. The CSL share price is quoted in Australian dollars. The Australian dollar is now a lot stronger than it was compared to the US dollar a year ago, going from $0.63 to $0.76. If you took the currency decline at face value, that could explain most of the decline.

But CSL’s earnings are actually higher than they were before.

The giant healthcare business reported a strong first half of the 2021 financial year.

Its net profit after tax (NPAT) grew by 44% in constant currency terms to US$1.81 billion. Its earnings per share (EPS) also grew by 44% to US$3.98. There was a “exceptionally strong” performance by Sequirus. This division more than doubled its EBIT (EBIT explained) to $693 million. This was driven by large growth of seasonal flu vaccines with record demand and the ongoing shift to Seqirus’ differentiated and high value product portfolio.

However, consistent with the seasonal nature of the business, it’s expecting a loss in the second half of the year.

Its plasma collections continue to be affected by the pandemic, but CSL has introduced strategies to combat this.

CSL is expecting FY21 profit to be in the range of $2.17 billion to $2.265 billion, representing growth of up to 8% year on year.

So, is the CSL share price good value?

Using the earnings forecast on CommSec, CSL shares are valued at 40 times the estimated earnings for the 2021 financial year. That’s pricey for such a large business. It doesn’t seem so expensive if you exclude the R&D costs that CSL spends each year, however, it’s still fairly expensive with single digit profit growth. And CSL is still spending that cash.

Summary thoughts

CSL is a high quality business, that could be worth owning in a long-term portfolio. But there are quite a few smaller ASX growth shares that I think could make better value buys.