Airtasker Ltd (ASX: ART) shares continue to be some of the most frequently traded since listing on the ASX last month.

After reaching highs of close to $2 per share, Airtasker’s valuation seems to have stabilised for now around the $1.30 mark.

Before arriving at any conclusions about Airtasker’s valuation, it may also be worth gaining a more thorough understanding of the company and identifying which characteristics help it stand out from its competitors.

Airtasker share price

Infinitely horizontal model

Airtasker’s business model as an online labour marketplace certainly isn’t the first of its kind. However, many of its competitors that offer local services often focus on only a limited number of verticals or service categories.

Some examples of this would be Uber Technologies Inc (NYSE: UBER) for ridesharing, Care.com for child care services, and Hipages for building and home services.

In comparison, Airtasker is said to have a horizontal model referring to the wide range of services that can be listed on its platform.

Airtasker’s Total Addressable Market (TAM) is likely to be much larger than a company such as Freelancer Ltd (ASX: FLN) which only focuses on remote services. It’s estimated that remote services only account for 11% of total service jobs, with the remaining 89% being attributed to local jobs that Airtasker is able to facilitate.

Revenue model

Revenue models vary across online labour markets, with common examples including lead generation fees as well as commissions based on transaction values.

Airtasker falls into the latter category and charges both the customer and the tasker based on the agreed value of the task.

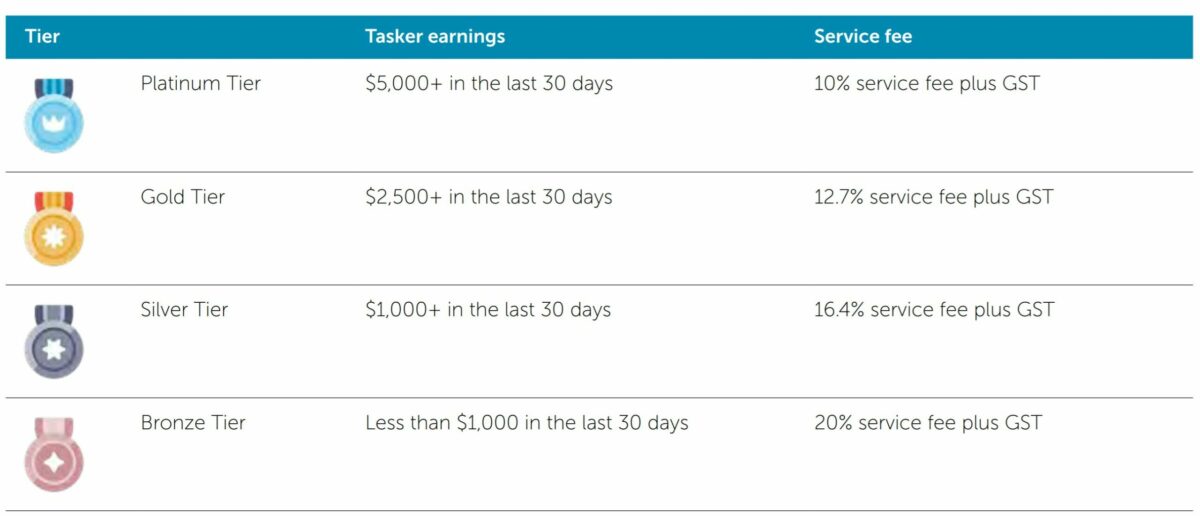

The majority of revenue comes from the taskers service fee and is contingent on the tasker’s earnings in the last 30 days. As you can see from the image below, taskers that earn the most are rewarded by paying the smaller service fee (or penalised for working less, depending on which way you frame it).

Even the lowest service fee of 10% seems quite high in my opinion and I wonder if any taskers essentially surcharge this cost by increasing their “fair value” transaction amount by the service fee percentage.

If this is the case, would customers be better off engaging with a worker directly in order to avoid fees and other costs?

Buy/sell/hold?

Airtasker remains to be a hold for me at these levels.

I generally stay away from stocks that have recently IPO’d due to the fact the many of them underperform despite many of them often being quality companies.

I’ll need to see a longer track record of performance before I’d be investing in Airtasker.

For more share ideas, click here to read: 2 high quality ASX retail shares to watch in April.