No need to get a telescope, that’s the BrainChip Holdings Ltd (ASX: BRN) share price shooting across the stars. Why is the BrainChip share price soaring?

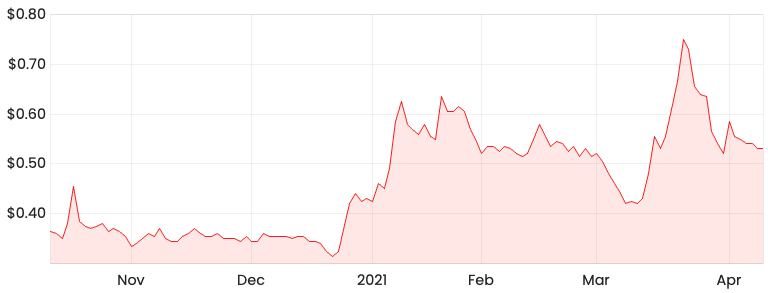

BRN share price

BrainChip commences production of Akida

BrainChip has developed a propriety neuromorphic processor called Akida

. This is designed to help customers create chips and systems that are compact and power-efficient.

For example, the US National Aeronautics and Space Administration (NASA) placed an order for the Akida early access evaluation kit as covered by my colleague, Patrick Melville.

Customers from BrainChip’s early access program (EAP) ended up purchasing Akida for a range of applications.

Today, BrainChip announced it will commence volume manufacturing of Akida for Artificial Intelligence (AI) devices.

The company notes after testing the Akida samples, it managed to improve the design in performance, efficiency, and scalability.

Management thoughts

BrainChip CEO, Peter van der Made appeared to be quite excited about this major milestone as he announced, “This move to manufacturing is a major milestone for BrainChip and for the industry at large as the first realistic opportunity to bring AI processing capability to edge devices for learning, enabling personalization of products without the need for retraining.”

Peter van der Made also thanked the EAP customers for leading the business to market readiness.

My thoughts

As highlighted in Patrick Melville’s article, BrainChip is yet to release figures relating to the first licence agreement and the NASA EAP.

Without key values, it is difficult to get a sense of the potential financial performance of BrainChip.

Whilst it is encouraging to see that there appears to be EAP customers, who purchased Akida, there are no numbers to back this statement.

I can understand why the market reacted so favourably upon such news because it seems like BrainChip has developed cutting-edge technology in a hotly discussed area, being AI.

Given BrainChip operates in such a technologically advanced space, this would fall outside my circle of competence, which can be treacherous.

So, if you are considering investing in BrainChip, it’s important to determine whether you have adequate knowledge to understand BrainChip’s business and product rather than being swayed by popularity.