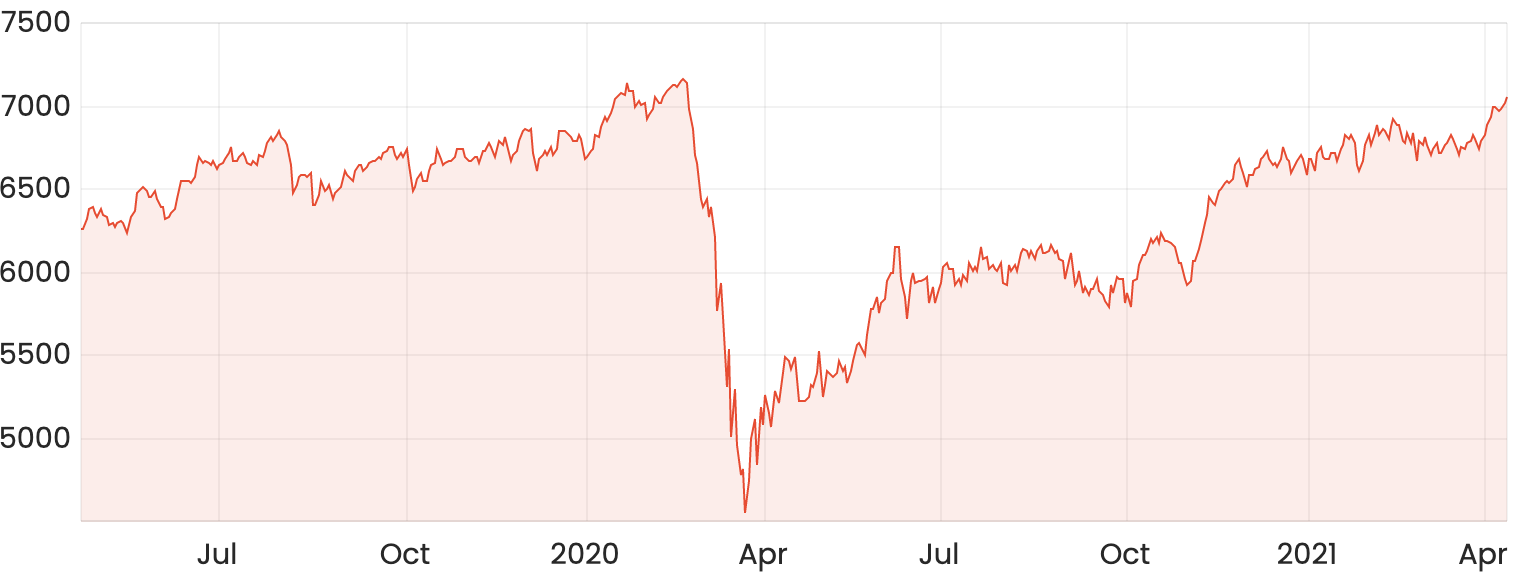

The S&P/ASX 200 (ASX: XJO) is within just 100 points of an all-time high, finishing 0.5% higher on Thursday, and slowly catching up to a US market that is hitting new highs almost every other day.

ASX 200 chart

The day was all about the mining and energy sectors, with US crude inventories running low, sending the oil price up 5%.

Signs of a recovering economy also supported both Fortescue Metals Group Limited (ASX: FMG) and CSR Limited (ASX: CSR), which both finished 3.5% higher.

In contrast, Boral Limited (ASX: BLD) finished just 0.5% higher despite flagging further corporate activity, with management assessing the option to divest its fly ash business as the coal stations it relies upon begin to shut down.

In economic news, the remarkable Australian recovery story continues, unemployment falling from 5.8% to 5.6% in March, with another 71,000 jobs added.

Most importantly, hours worked rose to a record 1,800 million, up 2.2%, along with the participation rate which reached 66.3%. All signs point to a strengthening of the consumer-led recovery.

Qantas Airways Limited (ASX: QAN) is one company likely to benefit, with management revising its estimate and now expecting domestic flights to move beyond 90% capacity in the final quarter of the financial year. The Qantas share price fell 0.2% despite the positive news.

Netwealth Group Ltd (ASX: NWL) and Pendal Group Ltd (ASX: PDL) each released March quarterly flows updates. Netwealth’s funds under administration increased 7.8% quarter-on-quarter to $41.8 billion, while Pendal’s funds under management grew by 4.4% on the December quarter to $101.7 billion. Netwealth and Pendal shares jumped 2.4% and 4.3%, respectively, on the news.

Looking ahead, the ASX 200 is set to open higher to close out the week on Friday. Mineral Resources Limited (ASX: MIN) will be on watch after releasing its latest quarterly activities report.