The Whitehaven Coal Ltd (ASX: WHC) share price experienced a steep fall of 14.8% yesterday. Was the Whitehaven Coal share price drop mainly due to the March quarter results?

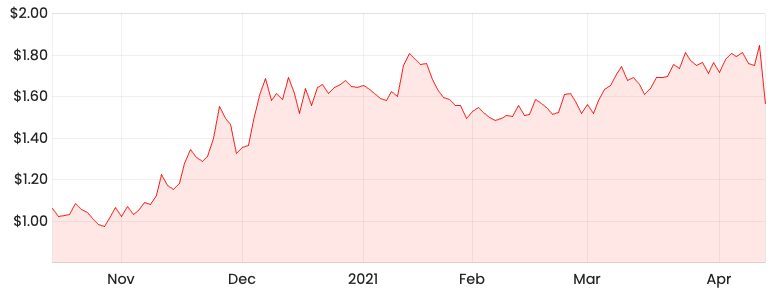

Whitehaven Coal share price

Increase in sales but logistical issues

Overall, coal sales had improved slightly compared to the last quarter and the prior corresponding period (PCP), being the March 2020 quarter.

Whitehaven Coal experienced a number of logistical challenges due to adverse weather in recent weeks.

The company noted coal prices have continued to improve over the quarter as a result of increased economic activity as well as supply constraints.

FY21 guidance revised down

Whitehaven Coal advised one of its key underground mines located in Narrabi was impacted by continuing geological issues. This has resulted in unscheduled downtime and additional equipment repairs.

These challenges have forced management to revise down its guidance for FY21 production, sales and unit cost.

What now for Whitehaven Coal?

The business operates in an industry that will become less important over the long term because of the rising adoption of renewable sources of energy.

I prefer not to invest in such businesses as it doesn’t align with the Rask Investment Philosophy.

Whilst it is encouraging to see prices increasing due to a rebound in demand for coal, it’s still a commodity where the price is dictated by the market.

I am more interested in businesses that are capable of raising their prices through product or service quality.

Before you consider Whitehaven Coal shares, you can click on this link to ASX growth shares and find lots of ASX stock ideas and analysis.