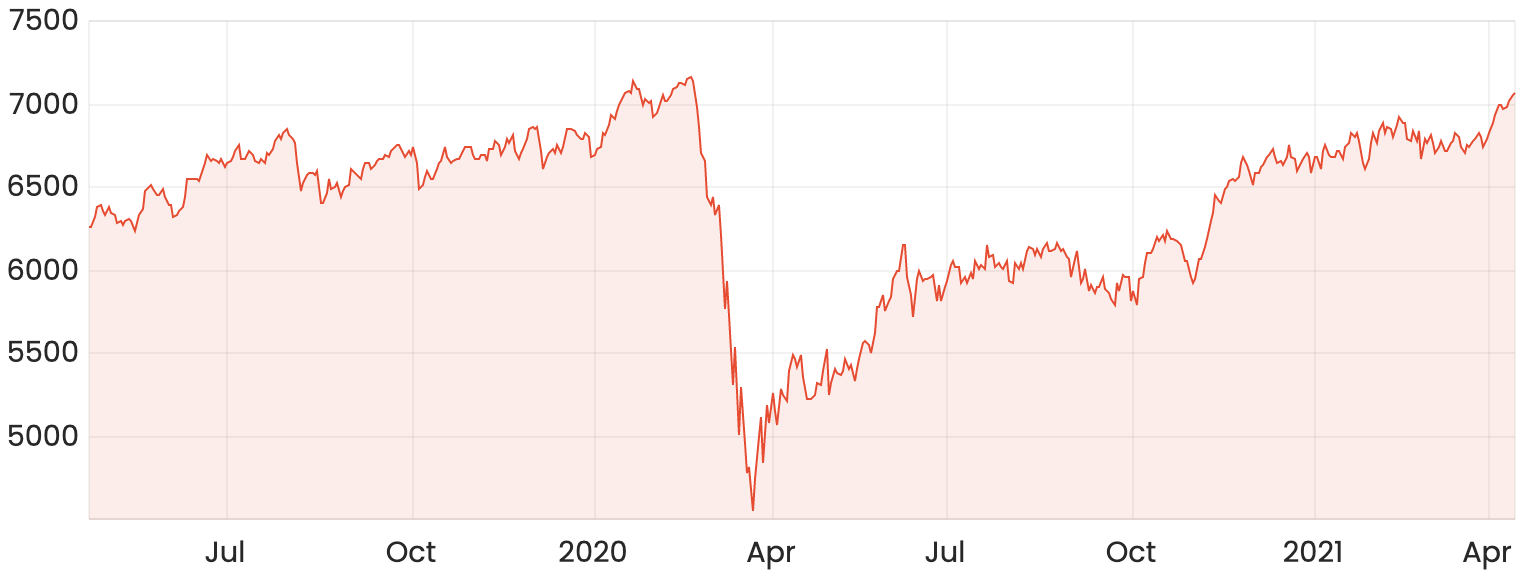

The S&P/ASX 200 (ASX: XJO) managed a small gain despite a volatile day on markets, finishing 0.1% higher on Friday to take the weekly gain to 1%.

2-year ASX 200 chart

Once again the tech sector is leading the way, jumping 4.4% over the week as it appears inflation and interest rate concerns have receded for the time being.

Zip Co Ltd (ASX: Z1P) outperformed, jumping 12.9% with a number of mining companies among the leaders.

Healthcare was next, adding 1.9% and mining 1.5% as the weakening AUD supported global businesses.

The iron ore price hit a new record high, US$211 per tonne despite environmental restrictions hitting demand from Chinese steel mills.

Origin Energy Ltd (ASX: ORG) was the biggest disappointment, falling 8.9% on Friday and 9.7% for the week after cutting earnings guidance from $1.0 billion to $940 million following an ‘adverse and unexpected’ contract price review on its supply deals with Beach Energy Ltd (ASX: BPT); BPT jumped 4.6% on the news.

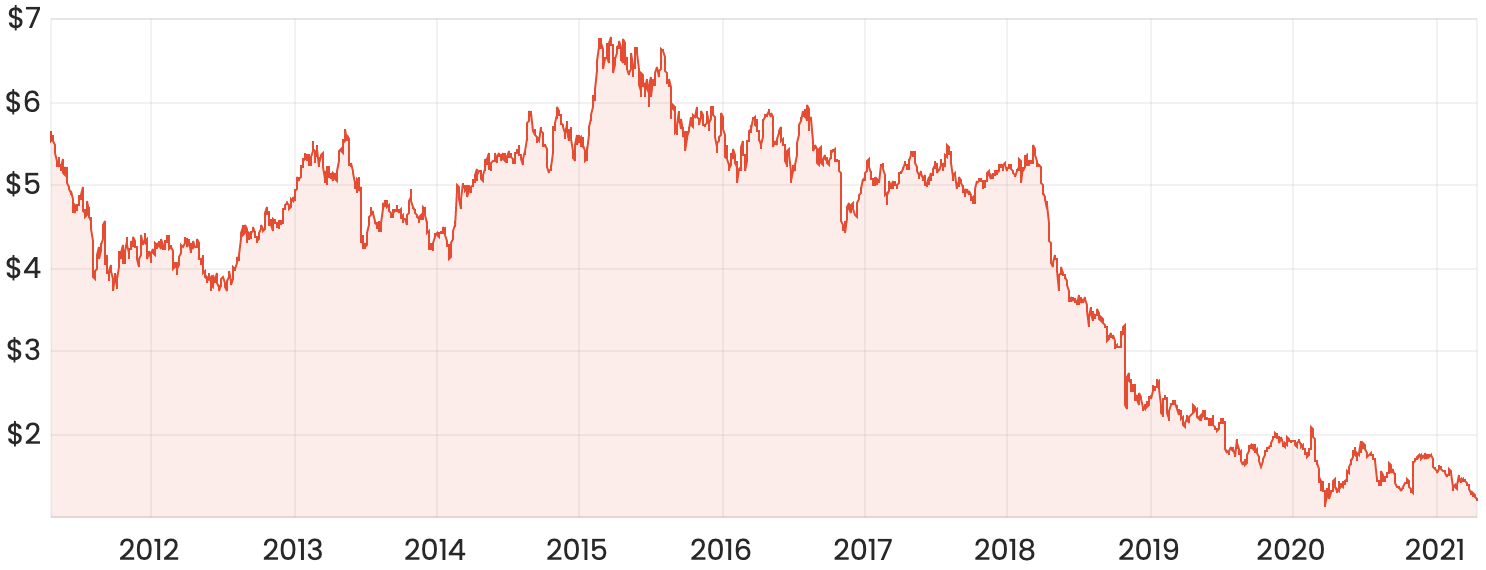

Meanwhile, AMP Ltd (ASX: AMP) fell 2.5% to a new record low as the difficulty of breaking up its business becomes more clear.

AMP share price chart

The Chinese economy reported the strongest growth rate on record, jumping 18.3% compared to the same time last year, but the headline data has hidden quarterly growth of just 0.6% for March, among the weakest in several decades.

In other news, Mineral Resources Limited (ASX: MIN) handed in its March 2021 quarterly activities report, noting problems with its iron ore shipments. Mineral Resources shares finished the day 5.3% lower.

To end on a positive note, Eagers Automotive Ltd (ASX: APE) jumped 2.4% after the car dealership group revealed its profit is racing higher.

Looking ahead, the ASX 200 is tipped to open 0.5% higher on Monday according to the latest ASX futures.