The QuickFee Ltd (ASX: QFE) share price falls on the back of strong US growth in the third quarter of FY21. What does this business update mean for the QuickFee share price?

QFE share price

QuickFee records strong US growth

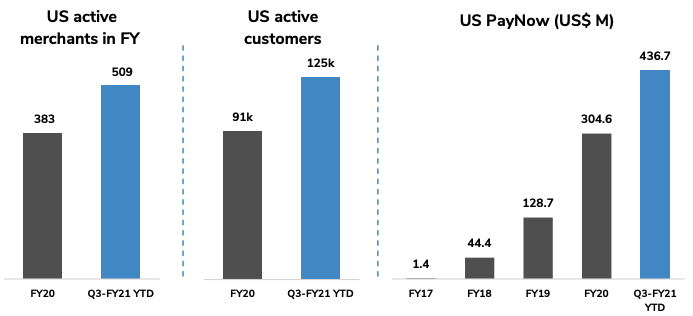

QuickFee continues to gain market share in the US, recording solid growth in both active merchants and active customers.

The number of active merchants in the US surged by 62% for this financial year to date relative to the prior corresponding period of FY20 (PCP).

Across the same period, the number of US active customers rose by 135%.

Furthermore, the transaction volumes in the US PayNow jumped by 128% for the quarter and up 161% over the year to date.

The performance of QuickFee’s Australian operations is a different story though. The number AUS active merchants had fallen by 3% compared to the PCP.

As for AU active customers, this increased slightly by 4% over the same period.

QuickFee lending jumps in the US but drops in AUS

The company notes US lending continues to be impacted by the US government’s Paycheck Protection Program as well as the approved US$1.9 trillion stimulus package measures.

Compared to the last quarter in FY20, US lending was down by 6% but for the year to date, US lending rose by 24%.

QuickFee’s Australian lending services suffered declines of more than 40% on a quarter and year to date basis relative to FY20. The business notes this is due to government stimulus measures.

Despite the drop, the company advises March was the strongest lending month of FY21 and is optimistic that lending demand will continue to improve.

Should you act quickly?

If you want a more in-depth explanation of the QuickFee business, I recommend watching the video below.

It’s evident that QuickFee’s future growth is driven by its US expansion strategy and it appears to be executing on this front.

Whilst the Aussie operations has gone through a difficult period, it may bounce back as businesses feel the effects of the removal of Jobkeeper and government stimulus measures.

As part of the Rask Investment Philosophy, I invest with a long-term mindset.

Accordingly, I think the accounting and legal professional services will remain as important if not more important in years to come. So, I would consider whether QuickFee is operating in a growing market and will its key customer targets become reliant on its services?

If you are interested in other similar buy-now-pay-later companies like Afterpay (ASX: APT) and Zip Co Ltd (ASX: Z1P), get your ultimate BNPL sector report below.