It seems everyone is monitoring the Latitude Financial Services Group Ltd (ASX: LFS) share price as it prepares to list on the ASX today. Other than the Latitude share price, what else should you consider?

Latitude is a leading digital payments, instalments and lending platform, with ~2.8 million customer accounts and roughly 2,000 merchant partners across Australia and New Zealand.

How does Latitude make money?

Similar to other banks like Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC), Latitude generates revenue from net interest income on its lending products.

These lending products include credit cards, personal loans and motor loans.

Latitude also generates a small percentage of revenue from insurance related to its lending and instalments products.

The key expenses of the business include interest expenses, loan write-offs, employee expenses and other overhead expenses.

Latitude’s past financial performance

Interest income for FY20 had dropped by 12.2% relative to FY19 and interest expenses rose by 31.1% over the same period.

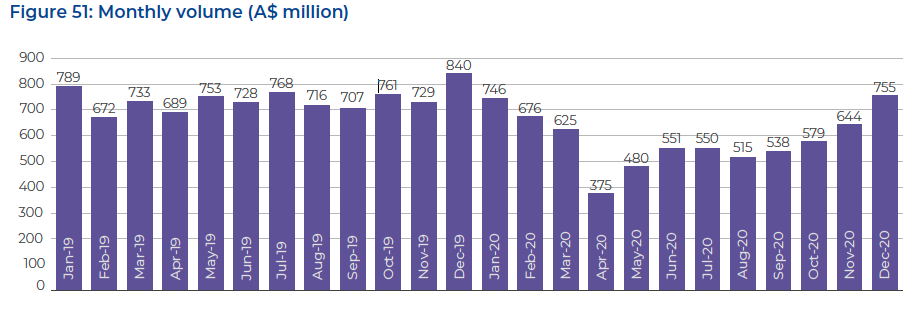

As you can see below, the monthly loans volume fell significantly subsequent to the onset of the pandemic.

Latitude advises this was mainly attributed to a fall in consumer confidence in spending, credit risk mitigation strategies due to rising unemployment and customers preferring to reduce credit exposure in uncertain economic times.

However, monthly loans volume quickly picked up again towards the end of 2020.

My take on Latitude

Latitude primarily derives its revenue from the volume of loans. So, if consumer confidence bounces back and people start embracing credit again, this works in Latitude’s favour.

On this note, investors should monitor trends in the way consumers spend, as recent surveys reveal a possible shift away from credit.

As part of the Rask Investment Philosophy, I prefer to invest in businesses with products or services that are embedded in people’s lives. So, no matter what happens to the economy, people or businesses still need to use it like accounting software provided by Xero Limited (ASX: XRO).

There are three other things that you should consider for Latitude’s IPO covered by my colleague, Owen Raszkiewicz.