The AGL Energy Limited (ASX: AGL) share price is hovering at record lows for the past decade. What does the CEO exit mean for the future of the AGL share price?

AGL is involved in the production and retailing of electricity and gas for residential and commercial use. One of its key competitors is Origin Energy Ltd (ASX: ORG).

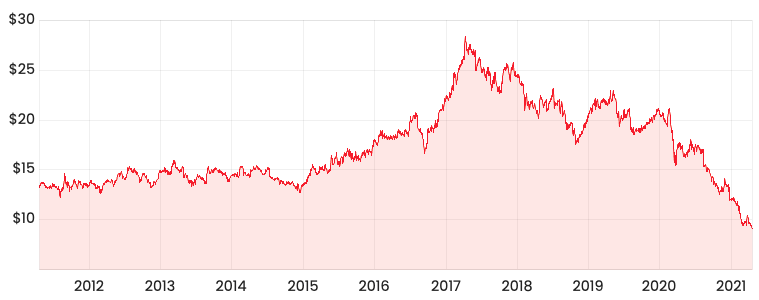

AGL share price

AGL CEO leaves

The Managing Director and CEO of AGL, Brett Redman has resigned after almost 15 years with the company, including the past two-and-a-half years as CEO.

Redman states he is unable to make a long-term commitment beyond the proposed structural separation announced on 30 March 2021.

His resignation is effective immediately but will be available until the expiry of his notice period on 21 October 2021.

Redman said he was particularly proud of assembling Australia’s largest electricity generator and founding Australia’s largest renewable investment fund.

AGL appoints an interim CEO

AGL’s current Chairman, Graeme Hunt, has been appointed as Interim Managing Director and CEO. Hunt will immediately step down and Non-Executive Director, Peter Botten has been appointed as his replacement.

As a result, Hunt will lead the structural separation process where he will need to consider the appropriate long-term leadership of the two proposed new businesses.

What does this mean for AGL?

Given Redman’s extensive experience at AGL and involvement with the renewable investment fund, this is a big loss for the business.

This departure makes it a more challenging road ahead as it faces headwinds from a growing shift towards renewable energy.

Whilst it’s encouraging to see the business transitioning to cleaner forms of energy, falling wholesale energy prices are still putting pressure on margins.

I would rather look for businesses that are less exposed to external commodity prices and operate in structurally growing industries.

If you’re after investment ideas, check out our ASX shares ideas hub where you’ll find lots of ASX stock ideas and analysis. Or, grab a free Rask account and access our in-depth, analyst-backed stock reports.