Megaport Ltd (ASX: MP1) has released its update for the third quarter of FY21. How will this affect the Megaport share price?

Megaport share price chart

Megaport records consistent growth

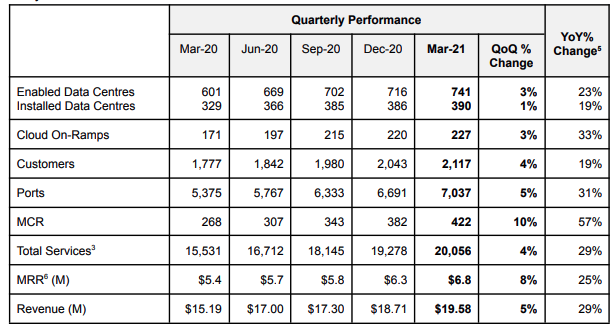

Megaport recorded solid growth across both monthly recurring revenue (MRR) and total revenue in the third quarter (3Q).

If you compare these figures on a quarter on quarter (QoQ) basis, meaning the same quarter of FY20, MRR jumped by 8% and total revenue increased by 5%.

The number of customers also rose by 4% QoQ to 2,117 customers.

Other key performance metrics used by Megaport are illustrated below.

As you can see, all metrics have been growing even though the rate of growth has slowed down. This is a reflection of Megaport operating in a structurally growing industry.

Megaport releases a new product

On 31 March 2021, the business announced the launch of Megaport Virtual Edge (MVE). This sounds really cool but what does it actually mean for customers?

Well, MVE will enable its customers to connect their critical branch locations to the services that power their IT solutions, alleviating their reliance on data centre locations.

As a result, this new product will expand the company’s total addressable market (TAM) for connectivity and interconnection services. This is a key business characteristic that we look for at Rask.

My mini summary thoughts on Megaport

Despite recording continued growth in revenue, it appears this has not translated into higher cash receipts.

Cash receipts for the quarter were $20.2 million, a drop of 22% compared to the last quarter.

As highlighted in my previous article, the business is still at a capital-intensive stage of its life. So, I would continue to monitor the level of cash burn as Megaport continues to build its data centres.

Whilst growth in revenue is important, it won’t matter if the company is unable to generate adequate free cash flow in the future.

To keep up with our latest research, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.