AVA Risk Group Ltd (ASX: AVA) released its Q3 trading update to the market today, to which its share price subsequently fell by around 2%.

Here’s what you need to know.

AVA share price

Key takeaways

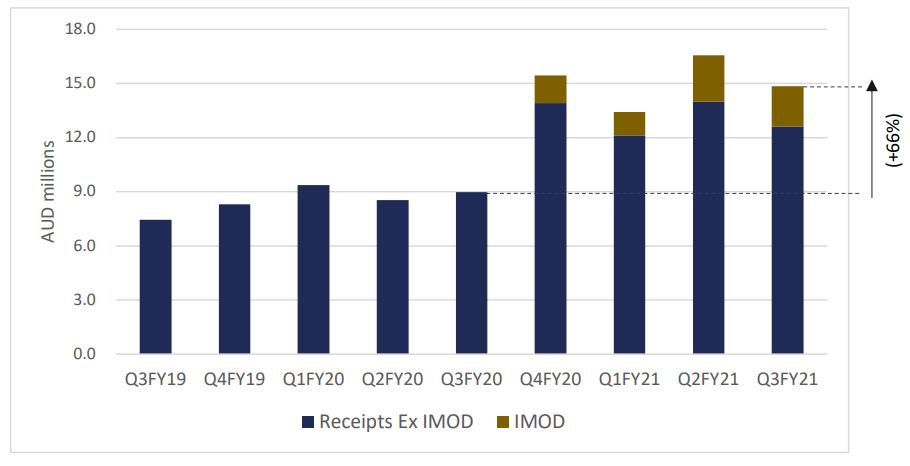

Over the past three months, AVA collected cash receipts of $14.8 million, an increase of 66% on the prior corresponding period (pcp).

Net cash from operating activities was $3 million, up from $1.1 million on the pcp, which helped the company finish the period in a strong financial position with $11.7 million cash in the bank and no debt.

Ava paid $4.4 million worth of a special dividend to shareholders on 10 March following an outstanding first quarter, which saw the company report record levels of revenue and EBITDA.

Strong growth ex-IMOD

One of the biggest catalysts behind the rise in AVA’s valuation has been a $15.4 million Indian Ministry of Defence (IMOD) contract.

As you can see from the image below, while the IMOD contract has made up a large concentration of cash receipts, it’s by no means its only source of growth.

Excluding IMOD, group receipts have increased by 48% on the pcp as it recorded growth across all of its three business segments.

Aura IQ

Ava’s latest weapon in its arsenal, Aura IQ has apparently generated significant interest recently and a number of proof of value trials were initiated over the quarter.

The company expects to enter new contracts to deploy Aura IQ to multiple sites during Q4 FY21.

Final thoughts

This has been a fairly average update in my view. I can understand why the market hasn’t reacted too positively to it.

In previous quarterly updates, AVA has provided individual breakdowns of its three business segments, which explicitly states important metrics such as revenue, EBITDA and gross margins.

This recent quarterly has been formatted in an entirely different way that looks at AVA as a whole and rather focuses on cash receipts.

I definitely prefer the former as it gives a clear picture of where the growth is coming from.

Based on this update, there’s no accurate way to tell how the high margin technology segment has been travelling and how this compares to the rest of the business.

Investors have been told for quite some time that Aura IQ proof of value trials would soon start translating into contract wins, but it looks like this has been kicked down the road again for the time being.

The other elephant in the room weighing on its valuation is the IMOD contract will wind up shortly.

In my view, AVA needs to win contracts that are on a licencing model similar to its IMOD contract, otherwise, the investment case is significantly weaker.

I wrote an in-depth article on AVA that explains why I think the risks are more skewed towards the downside based on its current valuation.

I’d also recommend signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.