The Blackmores Limited (ASX: BKL) share price has fallen by as much as 4%. What is happening to the Blackmores share price?

A2 Milk Company Ltd (ASX: A2M) suffered a similar fate today. Is there a common denominator?

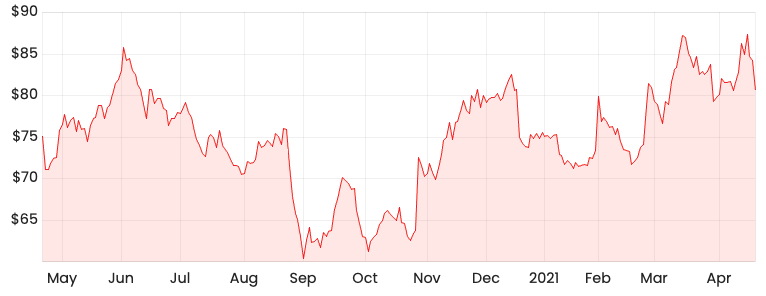

Blackmores share price

Border lockdowns continue to heap pain

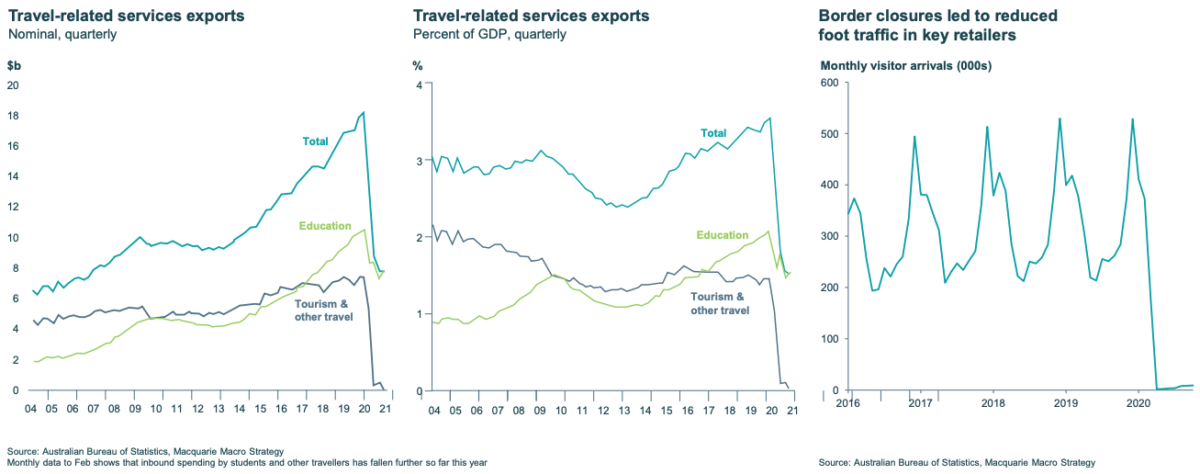

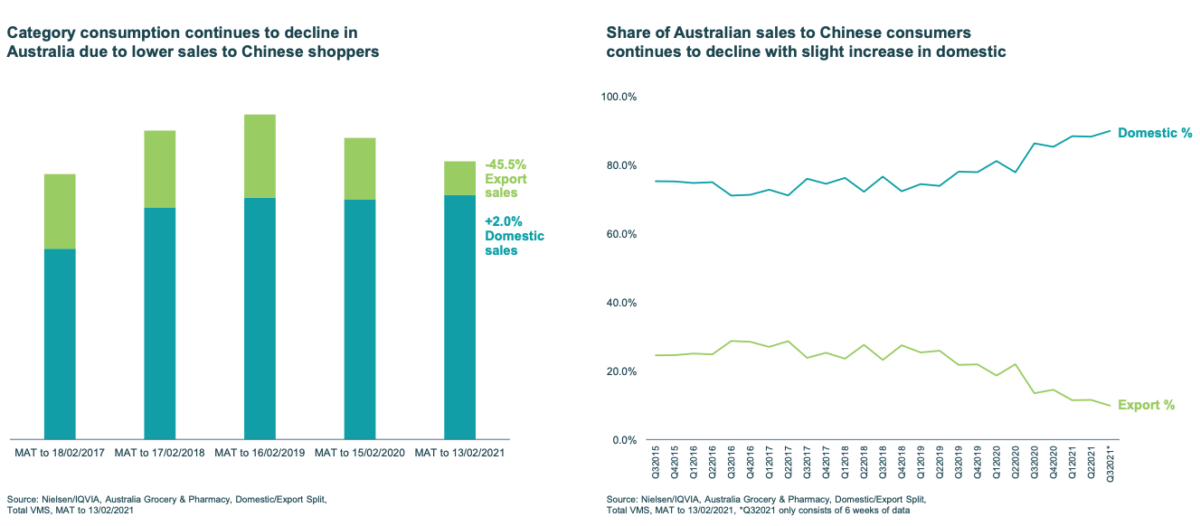

Despite recording strong revenue growth in China and its international segment for HY21, Blackmores expects inbound spending to be significantly down in Australia.

The company notes this downward trend is driven by the absence of international students and tourists.

As you can see from the below, inbound spending has fallen dramatically.

Blackmores believes category consumption will continue to weaken until 2022 unless international borders re-open.

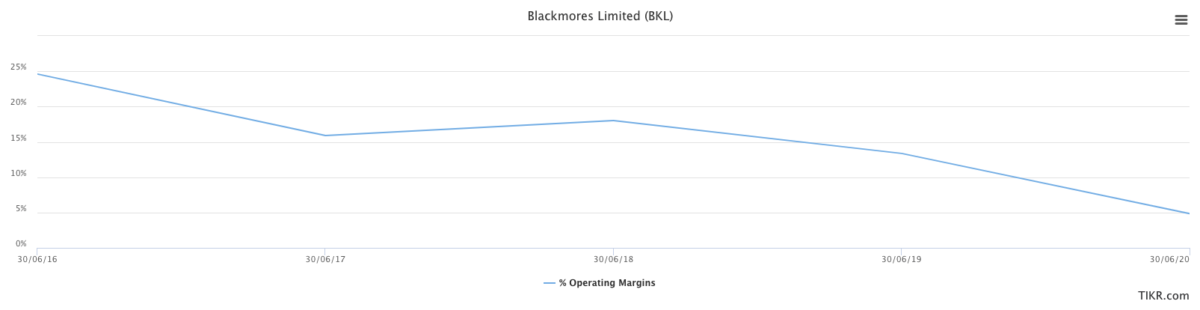

Blackmores operating margins a concern

Blackmores reported underlying EBIT of $30.8 million in HY21, a 15% increase over the prior corresponding period in HY20.

The company advised this improvement was due to cost control and the delivery of targeted supply chain efficiencies.

Investors should be careful when only looking at a fixed short-term period as recency bias can creep into your judgement.

Let’s zoom out and look at operating margins as a % of revenue over the last five financial years.

What is operating margins?

Operating margin is essentially the gross profit minus key operating costs like selling, general and administrative expenses as well as depreciation and amortisation.

Think of it like an investment property where you receive rent and you pay the agent a commission fee. This gives you gross income but how about all the maintenance and utility expenses you have to fork out?

Once you subtract all this, you get the underlying operating income. The juice between the gross income and operating income is your operating margin.

Summary thoughts

Even though operating margins as a % of revenue improved since HY20, it has been falling steadily.

Given Blackmores is constantly striving to offer the best health supplements, this requires ongoing selling and marketing costs. As a result, these costs eat into its operating margins.

As part of the Rask Investment Philosophy, I prefer to find companies with wide moats. In this case, I do not think a product differentiation strategy is sustainable over the long term.

If you’re on the hunt for ASX share ideas, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.