The Douugh Ltd (ASX: DOU) share price has been on a downward trend since its HY21 update. Can its partnership with Stripe, Inc lift the Douugh share price?

Douugh uses software technology to deliver a banking software service through a Software-as-a-Service (SaaS) model direct to consumers.

Users can feed their banking data into the software and Douugh’s technology can produce tailored financial coaching and guidance to consumers.

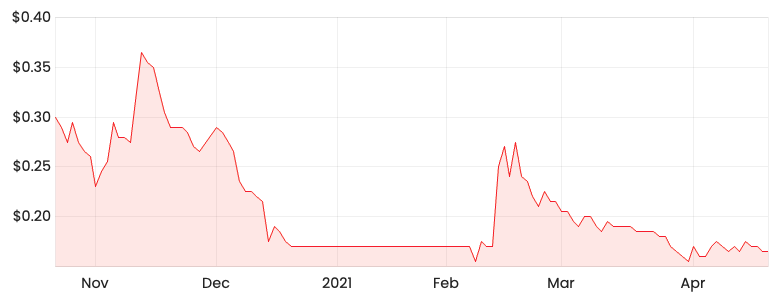

Douugh share price

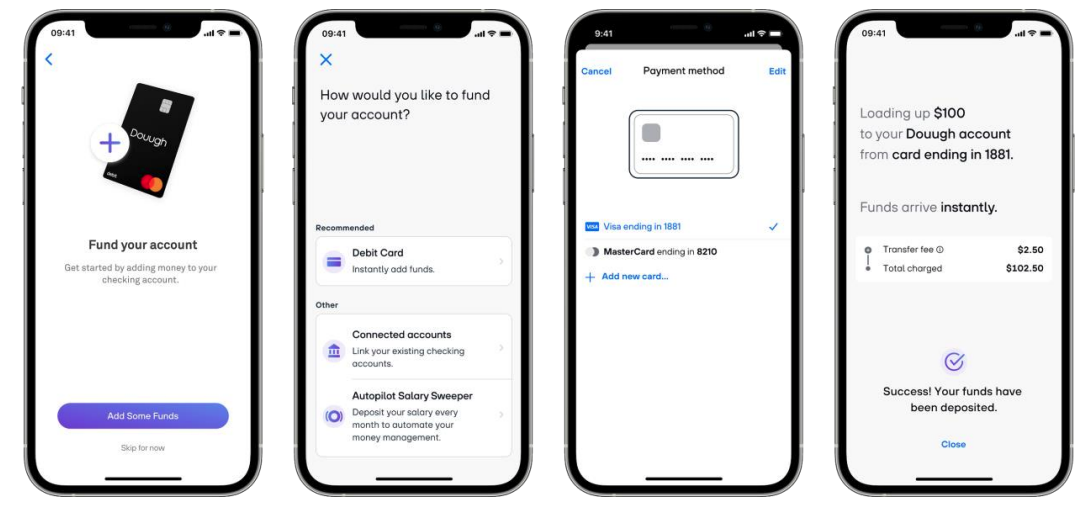

Douugh offers instant bank account funding

Douugh has launched its instant bank account funding feature, in collaboration with Stripe. Prior to this launch, loading funds on a bank account would take 3 business days.

As you can see below, funds can now arrive instantly on the Douugh app.

Douugh customers can now connect their pre-existing Mastercard Inc (NYSE: MA) and Visa (NYSE: V) debit cards to fund their Douugh bank account.

The Founder and CEO of Douugh, Andy Taylor indicated the feature introduces a new revenue line as it charges a 3% fee to customers for the convenience of instantaneous funds settlement.

My thoughts

It seems like Douugh is operating in a structurally growing space.

Afterpay Ltd (ASX: APT) is also focused on trying to offer budgeting and savings tools for customers by partnering up with Westpac Banking Corp (ASX: WBC).

New revenue opportunities in a growing industry is something that I look for as part of the Rask Investment Philosophy.

Customers tend to prefer convenience, so I think the instant feature will be attractive and bring in more revenue.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.