The share price of Sydney-based Next Science Ltd (ASX: NXS) surged over 45% at one point earlier today after a positive announcement made by the company.

Since its highs on open this morning, the share price is now trading at around $1.70, still 22% higher than the previous close.

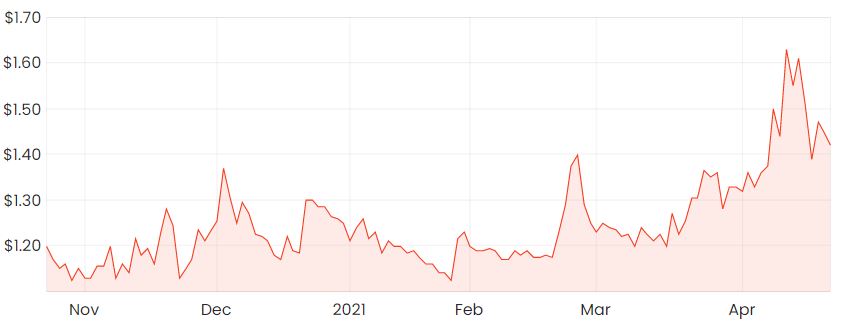

NXS share price

What does Next Science do?

It’s a medical technology company that’s been working on the development and commercialisation of a range of products that aim to reduce the impact of biofilm-based infections in human health.

One of its products is called Xperience, which is a single step application and is applied to the surgical site after closure, which aims to help defend against pathogens for several hours.

It’s designed for use for many types of surgeries including shoulder, knee and hip, and aims to prevent surgical site and post-operative infections.

FDA clearance

Today’s announcement that sent the share price flying revealed its Xperience No Rinse Antimicrobial Solution had received FDA approval and commercial sales will commence immediately in the US.

The product will be sold through a third-party distribution network comprising of over 300 agents. This will provide coverage to more than 90% of the US including 15,000 hospitals and ambulatory centres where over 100 million annual surgeries take place.

Next Science’s Total Addressable Market (TAM) appears to be fairly large and growing. In the US alone, the orthopaedic surgery market involves around 5.3 million surgeries per year, or around US$1 billion.

This represents a market opportunity of around $15 billion for its Xperience product.

Management commentary

Next Science Managing Director, Judith Mitchell said by using Experience, certain bacteria such as MRSA (“Golden Staph”) can be almost totally eliminated where less than 1 bacterium in a hundred million is present.

According to the company, surgical site infection (SSI) is the second-largest cause of hospital-acquired infection in the US and is a leading factor for increased mortality across the world.

Time to buy Next Science shares?

Today’s announcement seems to be a step in the right direction for the company, and I’ve added it to my watchlist for now.

As part of the Rask investment philosophy, we mainly focus on companies with a proven business model that is already generating some consistent cashflows, which is why I wouldn’t be buying shares just yet.

For more reading, I’d suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.