The A2 Milk Company Ltd (ASX: A2M) share price is officially below $7, which hasn’t happened since the end of 2017. This is my view on the current a2 Milk share price.

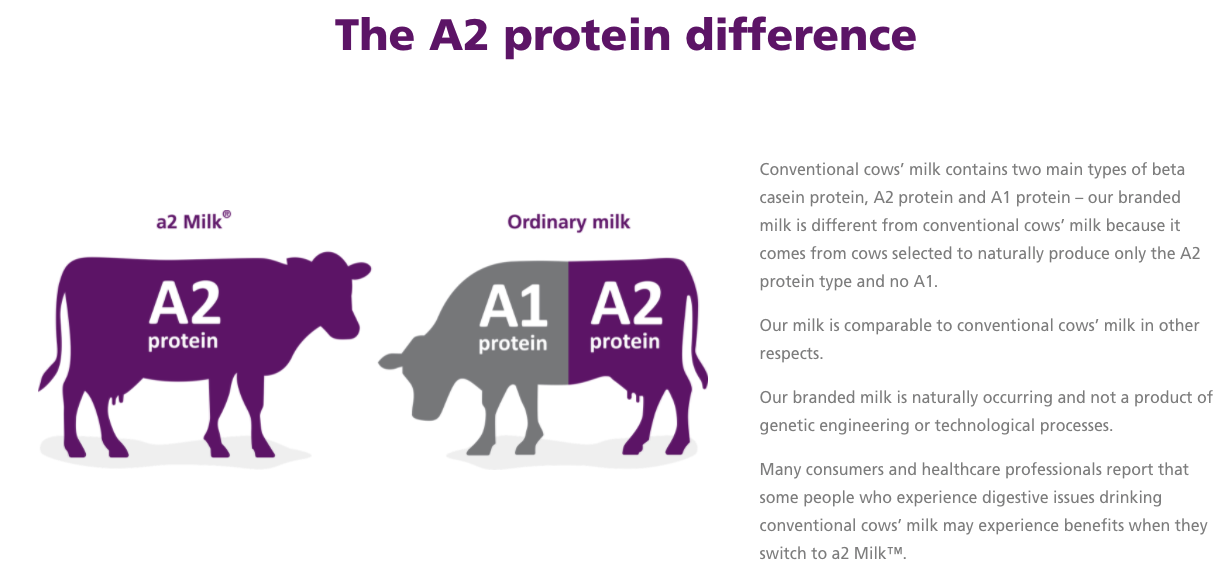

Prior to its acquisition of Mataura Valley in December 2020, a2 Milk was essentially a business focused on selling and marketing milk containing only the A2 protein type.

It used to outsource all the manufacturing and production.

A2M share price

Low barrier to entry

A2 Milk has built a really strong brand over recent years. It was primarily premised on marketing A2 protein as a healthier option for those with digestive issues.

However, whether A2 protein is actually better remains up in the air.

Regardless of whether A2 protein provides a scientific edge, a2 Milk has developed its competitive advantage on building the ‘a2 brand’.

A2 Milk is unable to register its ‘scientific edge’ as a patent. As a result, a lot of competitors have rolled out similar products containing the A2 protein.

Given a2 Milk is unable to build a moat around its product, it makes me question whether it is able to continue to charge a premium price relative to competitors. If competitors keep producing and market their A2 protein products, this may lead to lower margins for a2 Milk.

A shift towards alternative options

A2 Milk’s meteoric rise in the last few years has been mainly driven by a rise in demand from China via the Daigou channel.

The company still managed to record growth in Chinese revenue for HY21 compared to HY20 albeit at a much lower rate. This was mainly due to the border lockdown disrupting overseas sales channels.

There have been reports that Chinese locals have found domestic alternatives. I think this could be detrimental to a2 Milk’s future growth if it becomes permanent.

Consumer preferences could become a major headwind for a2 Milk as the number of alternative milk options grows e.g. almond, oat, organic.

Is a2 Milk past its use-by date?

The underlying fundamentals still remain intact given a2 Milk’s strong balance sheet with no debt and inside ownership is around 13%. Also, a2 Milk is sitting on a lot of cash.

In saying that, I would have preferred a2 Milk to use the cash forked out for the recent acquisition towards more value accretive activities.

At this stage, a2 Milk does not look particularly attractive given the potential pressure on margins from growing competition, an adverse shift in Chinese consumer preferences and the inclusion of manufacturing operations in the business.

My bearish view of a2 Milk should be considered in light of the bull case published by my colleague, Lachlan Buur-Jensen.