The Viva Energy Group Ltd (ASX: VEA) share price has been trending downwards recently. Will the Q3 results push up the Viva Energy share price?

Viva Energy supplies approximately a quarter of the country’s liquid fuel requirements. It is the exclusive supplier of Shell fuels and lubricants in the country across 1,200 service stations.

The company also operates the Geelong refinery in Victoria.

VEA share price

Signs of recovery for Viva Energy

Viva Energy notes it delivered some promising results despite continual headwinds in the form of lockdowns and flooding in some markets.

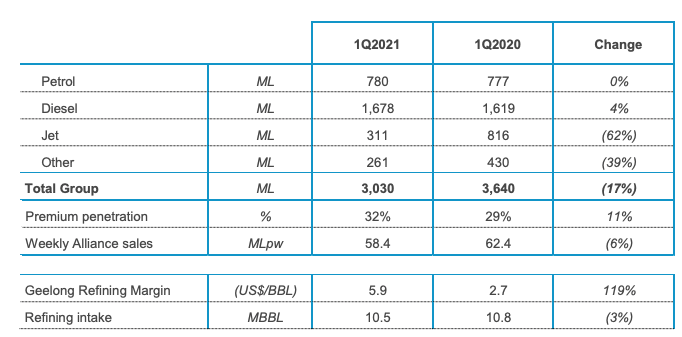

The company experienced a jump of 4% in diesel sales and premium petrol sales were up 11% compared to the prior corresponding period. Viva Energy says this was due partly to the continued rollout of V-Power to the broader Shell branded network.

It expects consumer demand for premium fuel to continue as it launched the “Fuel the Feeling” campaign, supporting its premium brand positioning.

Evidently, sales for the aviation sector dropped significantly due to border closures. However, domestic travel has started to pick up, which is promising for Viva Energy.

Refining continues to be challenging

The refining environment remains challenging as production levels remain well below long term averages.

As a result, the government has come in to help through the long term Fuel Security Package.

Viva Energy is expected to receive $19.6 million in temporary relief payments for Q1 2021.

Energy hub

Viva Energy continues to focus on developing its Energy Hub to address the projected shortfall in gas supply to the South-eastern states.

It has also entered a partnership with HYZON Motors to provide zero-emission vehicles coupled with hydrogen refuelling solutions to customers.

The company is currently scoping for a hydrogen refuelling hub in Geelong.

What now for Viva Energy?

As part of the Rask Investment Philosophy, I prefer to find businesses that are operating in structurally growing industries.

In the case of Viva Energy, its refinery business is looking untenable as it relies upon government funding. Also, the fuel industry is not an attractive prospect given the ramp-up in renewable energy sources.

Other competitors to keep in mind include BHP Group Ltd (ASX: BHP), Santos Ltd (ASX: STO) and Woodside Petroleum Limited (ASX: WPL).

If you’re interested in the ASX growth space, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.