Shares in Kogan.com Ltd (ASX: KGN) fell an additional 4.12% yesterday, meaning the company’s valuation has now slumped more than 17% since releasing its Q3 FY21 update last week, which wasn’t received too well by the market.

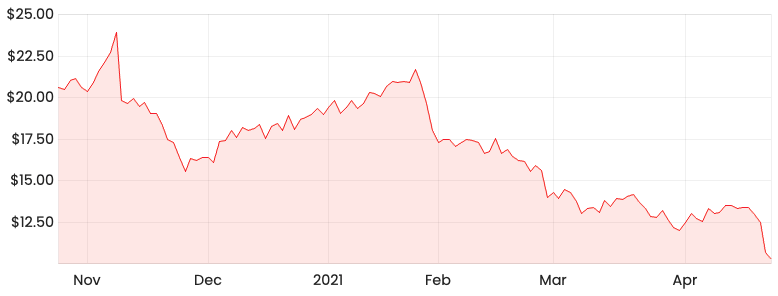

The 6-month share price chart below paints an even bleaker picture for the online retailer that was one of the largest COVID-19 beneficiaries.

After reaching highs of close to $25 per share in October last year, Kogan’s shares have now lost around 60% of their value.

KGN share price

Growth continues

Kogan reported strong numbers coming out of its third quarter, including revenue and gross profit growth of 65% and 54%, respectively.

These figures are compared to the previous corresponding period (pcp), in this case being Q3 FY20. While growth has continued, it’s quite likely the business has slowed down compared to Q1 and Q2 as the holiday season has come to an end.

Investors were most likely spooked by the company reporting a 24% decline in adjusted earnings before interest,tax, depreciation and amortisation (EBITDA explained), driven by increases in operating expenditures from higher inventory costs and a larger headcount.

Was Kogan’s update really that bad?

It seems as though Kogan has provisioned large quantities of inventory coming out of a busy holiday season and has now incurred higher than expected storage expenses as demand wasn’t as high as it anticipated.

This has resulted in some short-term pain, but given the rapid demand growth over the past 12 months, forecasting inventory would be a complex task and to me, it seems prudent to slightly overestimate inventory.

Increased spending on people and marketing also seems reasonable in my view.

Remember that companies like Kogan experienced unseen levels of growth this time last year after altering none of its marketing spend or headcount, i.e., It was purely demand-driven from government-imposed lockdowns.

Now that these businesses are operating on a much larger scale, more operating expenditures are required to continue to run the business sustainably at these much higher levels.

Summary

While Kogan’s shares have struggled over the past six or so months, I still think there’s a fairly strong investment case for a long-term outlook.

Kogan operates in a growing industry and there are some nice structural tailwinds involving e-commerce that are likely to sustain further growth even in a post-COVID economy.

For some more reading on Kogan’s shares, click here to read: Is the Kogan (ASX: KGN) share price finally in the buy zone? Here’s my take.

I’d also suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.