The Vulcan Energy Resources Ltd (ASX: VUL) share price lifted by more than 5% yesterday. Will the Vulcan share price continues its rise following an announcement on an acquisition?

Vulcan says that it is trying to become the world’s first ‘zero carbon lithium’ producer for electric vehicle batteries.

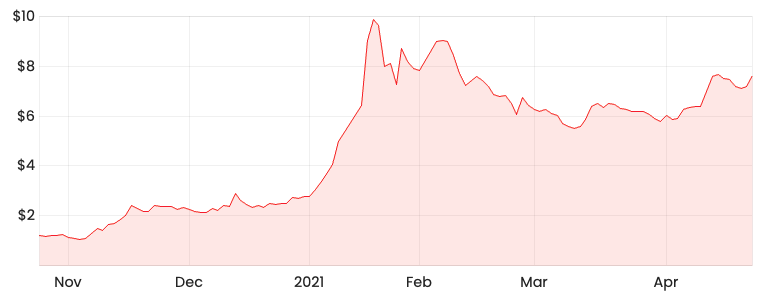

VUL share price

Vulcan acquires gec-co

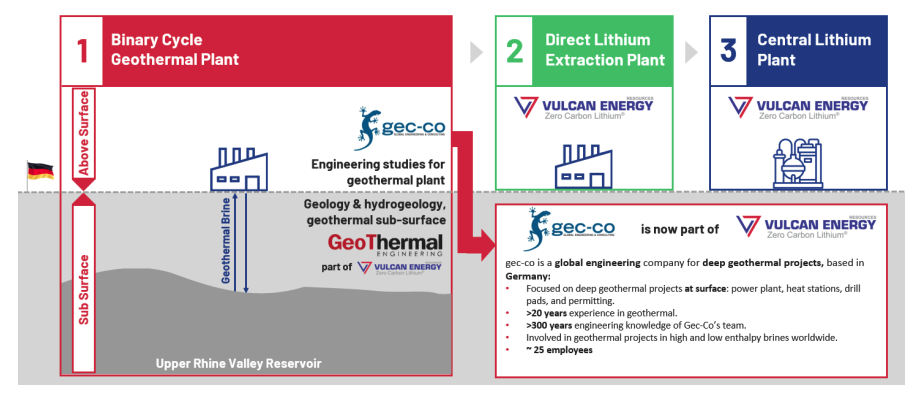

The company announced it has doubled the size of its technical team through a 100% acquisition of gec-co. Who is gec-co and why are they important?

Gec-co is a geothermal surface consultancy company that has significant experience in above surface development of geothermal projects. Examples include power plant, heat stations, drill pads, and permitting.

Vulcan’s expertise lies in its in-house lithium chemistry and chemical engineering team.

However, it needs a geothermal above surface development team to execute its overall goal of decarbonising heat and power to co-produce a world-first ‘zero carbon lithium’. This is why gec-co is important to Vulcan in executing its strategy.

The numbers behind the deal

Vulcan has agreed to offer 325,000 in fully paid ordinary shares upon completion of the acquisition. Two-thirds of these shares will be subject to 12 months’ voluntary escrow from the date of issue.

What’s a voluntary escrow?

It is a contractual agreement whereby the holder of the shares agrees to not dispose of it over the duration of the arrangement.

In addition to the above equity, Vulcan will pay €1,190,000 subject to the achievement of project development milestones for the Vulcan Zero Carbon Lithium Project.

My thoughts

The lithium production space is outside of my circle of competence, so I’m likely to stay away for the time being.

However, if you do have sound knowledge within this space, I would evaluate the quality of gec-co’s engineering team.

I would be asking Vulcan management, why they chose gec-co and what are the project development milestones.

These are just a few questions to start off with and many more questions should be considered as the project progresses.

If you are hunting for another ASX lithium share play, check out this article by my colleague, Patrick Melville.