The Kogan.com Ltd (ASX: KGN) share price is pushing slightly higher today after providing some further insight into its Q3 results which caused the stock to fall 17% last week.

Kogan has provided answers to nine questions asked by the ASX which further clarify some of the numbers from its Q3 update.

I think this is a reasonable request from the ASX.

Kogan’s Q3 update last week seemed to be a little opaque to me. Revenue growth percentages were provided, but other important metrics were omitted such as explicit revenue figures for each segment, as well as gross profit and earnings before interest, tax, depreciation and amortisation (EBITDA explained) figures.

KGN share price

Updated figures

During Q3, Kogan.com reported revenue of $161.8 million, up from $114.1 million on the prior corresponding period (PCP).

Mighty Ape reported revenue of $27.5 million but has come off a zero base due to it being a recent acquisition.

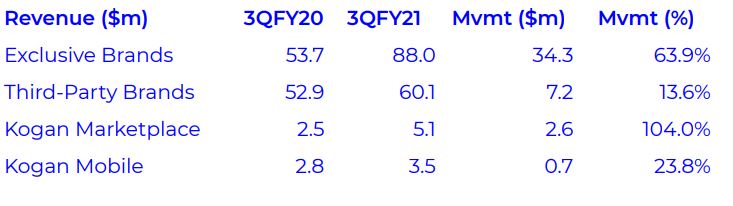

Across Q3, exclusive brands revenue grew by over 63%, third party brands by 13%, marketplace revenue by 100% and Kogan Mobile by 23%.

Kogan.com reported gross profit of $37.9 million, up 33.5% on the pcp, while Mighty Ape reported $6.1 million, also coming off a zero base.

The drop in EBITDA that caused many investors to panic last week was mainly attributed to the Kogan.com segment, which reported a 42.7% decrease on the pcp. Including the Might Ape segment, this number reduced to 24.8%.

What now?

I’m glad this update was requested by the ASX and that Kogan has provided some further numbers for investors to digest.

Kogan’s market valuation has dropped more than 60% since October last year as investors have shifted their attention away from COVID-19 beneficiaries into other areas.

In my view, there’s a chance the market may have overreacted during this recent downturn.

Like many other high growth companies, Kogan is sacrificing some short-term profitability to help drive top-line sales growth by reinvesting back into the business and increasing expenditure on marketing and its headcount.

It looks like there were some issues with inventory forecasting coming out of the holiday period, but it could be likely that they’re not ongoing issues.

I’ve never been a customer of Kogan, but reading some of its Trustpilot reviews gives some fairly mixed messages into the quality of its products and the user experience.

For some more reading, I’d suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.