It seems the Openpay Group Ltd (ASX: OPY) share price is trending downwards. Let’s dig into the latest business update and see how this will affect the Openpay share price.

Openpay is different from other buy-now-pay-later (BNPL) players like Afterpay Ltd (ASX: APT), Zip Co Ltd (ASX: Z1P), and Sezzle Inc (ASX: SZL).

Whilst Openpay still derives substantial income from retailers, it also has a strong focus on segments with higher transaction values like automotive, healthcare, and home improvement.

OPY share price

Openpay records strong growth

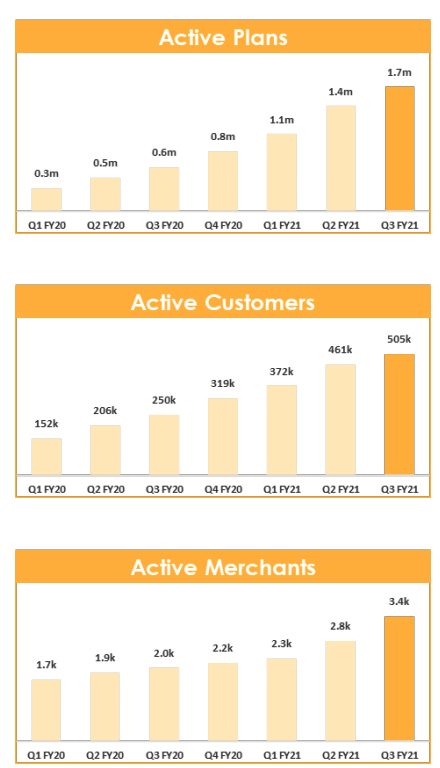

The company recorded solid growth in active plans, active customers and active merchants compared to the last quarter (Q2) and the prior corresponding period (PCP), being Q3 FY20.

Openpay secured some key agreements with Officeworks, Ford and entered into the hospital sector with St John of God Health Care. The business advises its the first BNPL player to enter the hospital segment.

Mixed bag on the financial front

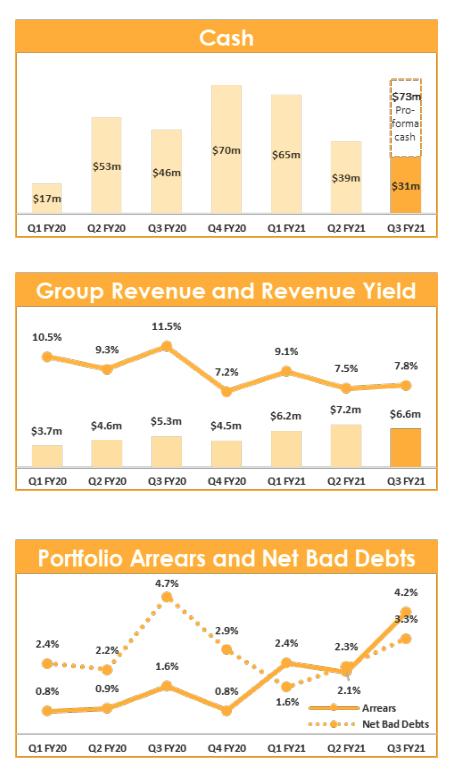

Despite growing its customers and merchants, this didn’t really translate to similar growth across the financial metrics.

Revenue jumped by 24% relative to the PCP due to the strong holiday retail trading period in Q2 FY21. However, revenue dropped from last quarter.

The company also notes the percentage of the net bad debt rate is 0.8% higher than its target range, which is not ideal.

The decline in cash has prompted the company to bolster its balance sheet through a $67.5 million funding package. This funding package comprises an institutional placement of $37.5 million, a corporate debt facility of $25 million and a share purchase plan of $5 million.

Openpay will use this funding to acquire more merchants across Australia, the UK and the USA.

My takeaway

As part of the Rask Investment Philosophy, I prefer businesses that operate in a growing industry with a big total addressable market (TAM).

Given Openpay is trying to penetrate an estimated global market of $22 trillion, I would expect continual high growth.

The strong growth in the number of customers and merchants indicate there is still plenty of opportunities. However, it’s concerning that revenue dropped.

Investors should also be mindful of the recent funding package, which will dilute existing shares.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.