The Frontier Digital Ventures (ASX: FDV) share price has gone up and down in the last six months. What does the latest quarter (Q1) update mean for the Frontier Digital share price?

Frontier Digital invests in and operates property, automotive and general online classified websites in emerging markets across countries and regions like Pakistan, Morocco and Central America.

These websites are striving to become the next REA Group Limited (ASX: REA), Domain Holdings Australia Ltd (ASX: DHG) and Carsales.Com Ltd (ASX: CAR) in emerging regions.

FDV share price

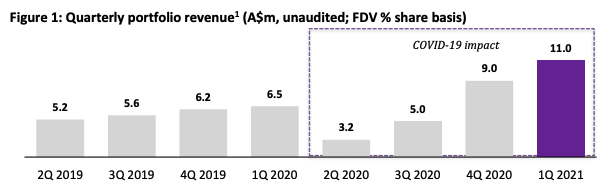

Portfolio revenue continues to rise

The portfolio of companies invested by Frontier Digital has generated $11 million in revenue for the quarter.

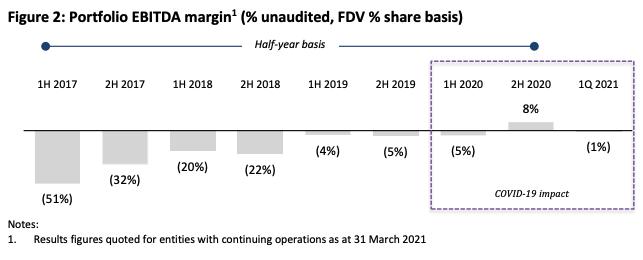

In terms of earnings before interest, tax, depreciation and amortisation (EBITDA explained) for the portfolio companies, the EBITDA margin was -1%, dropping from 8% in the last quarter.

Frontier Digital notes this would have remained at 8% if it wasn’t for its four new acquisitions.

Revenue was adversely impacted by the appreciation of the AUD against all local currencies, in particular, companies based in Myanmar due to political unrest.

More acquisitions and cash flows remain stable

The company increased its ownership in Moteur to strengthen its position in the new and used car market in Morocco.

Frontier Digital also made a 100% acquisition of the Chilean online classifieds portal, Yapo, which holds the number 1 position across the automotive and real estate verticals.

In relation to cash flows, Frontier Digital spent $12.5 million in cash outflows with customer receipts of $10 million in Q1 FY21. The business is currently sitting on $29.2 million in cash and cash equivalents.

My takeaway

Frontier Digital appears to be deploying a lot of cash and capital to increase its stake or fully acquire existing portfolio companies.

As a result, you will notice the operating cash outflows have been steadily increasing.

This presents some issues over the short term because once the business acquires its underlying portfolio companies, it will take on the operating costs of these businesses.

Given all these portfolio companies are spread out across different economic and political environments, I think there will be more pain to come over the short term.

My lack of knowledge of the economic and regulatory environment in these emerging markets puts this business outside my circle of competence.

If you’re on the hunt for ASX share ideas, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.