This morning, Dubber Corp Ltd (ASX: DUB) released its Q3 trading update, sending its share price up over 19% at the time of writing.

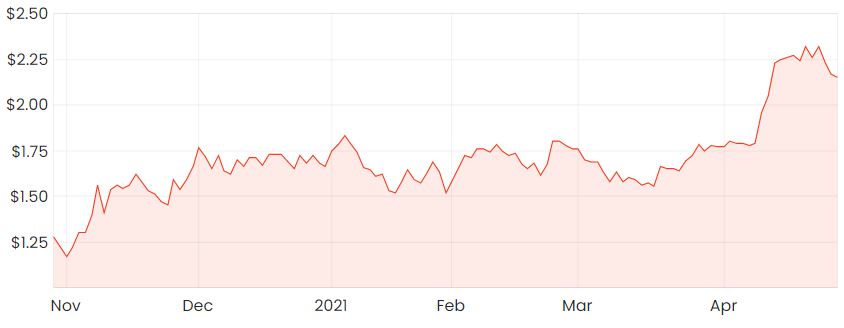

Over the past six months, the Dubber share price has gained an even more impressive 74% on the back of various positive announcements and partnerships.

Dubber share price

Dubber background

Dubber is a provider of cloud-based software used for call recordings. It can allow businesses to record and access voice data to improve call quality as well as compliance monitoring.

Its artificial intelligence (AI) platform is able to detect vocal sentiment, identify specific words and identify trends – all of which can be used to derive insights, retain more customers and provide an improved customer experience.

Strong quarterly update

Across the quarter, Dubber reported annualised recurring revenue (ARR) growth of 20% QoQ to $34 million and 158% on the prior corresponding period (pcp).

Revenue was up 54% to $6.6 million QoQ and cash receipts were also up 54% to $6.55 million.

Dubber finished the period with a cash balance in excess of $37.7 million and over 380,000 users across its platform.

User growth surges

During the March quarter, user numbers for Dubber’s Software-as-a-Service (SaaS) monthly subscriptions grew at record levels with over 380,000 subscribers, up 152% on the pcp.

Management believes this high level of growth is likely to continue into the current quarter partly due to the launch of its Foundation Partner Program, which allows Dubber’s services to be embedded within the partner’s offering. The advantages are mutually beneficial and enhance the functionality of both offerings.

Further developments

While traditional business communications have previously revolved around desk phones and mobiles, we’re now seeing the continued adoption of applications such as Zoom, Microsoft Teams and Webex.

Dubber has the unique ability to capture voice data from legacy systems as well as new platforms and is able to store voice data in a single location – the Dubber voice intelligent cloud.

Dubber has recently become one of only two vendors that are certified for compliant call recording for Microsoft Teams.

Summary

This is an interesting ASX growth share that I’ll be keeping my eyes on closely this year due to the many structural tailwinds working in its favour.

I don’t think COVID-19 will be a one-hit-wonder for applications like Zoom and Microsoft Teams, so it’s likely it could provide a sustainable advantage.

For more reading, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.