The consumer discretionary sector has been on the volatile end of the ASX recently, with many companies releasing quarterly figures that haven’t quite lived up to investors’ high expectations.

Some may think many of the underlying fundamentals have changed recently, but I disagree.

Here’s why I think Redbubble shares could be a fantastic long-term buying opportunity.

Redbubble

Redbubble Ltd (ASX: RBL) shares have been the latest addition to my own portfolio, as I believe the recent sell-off has presented an attractive entry point for a quality company with a compelling product offering.

RBL share price

Redbubble recently reported marketplace revenue (MPR) of $103.4 million for the quarter ending 31 March, or around a 50% drop compared to the previous quarter of $205 million.

This sudden drop in revenue coming out of the holiday period is a pattern that has consistently occurred in previous years not only for Redbubble, but many retailers for that matter.

This time last year, Redbubble reported Q2 and Q3 MRP of $110 million and $65.5 million, respectively, or a drop of around 40%, so a slower Q3 this year doesn’t come as a big surprise to me.

If the drop in revenue was expected, then why were shares sold off to the extent they were?

I think it would mainly be the possibility that Redbubble has been a once-off beneficiary of COVID-19 due to a rapid demand increase for things such as masks, but I don’t think this is the case.

Management addressed some of these concerns in a recent conference call. It was revealed mask sales only accounted for 6% of total sales for the most recent quarter, down from 8% in Q2 and 21% in Q1.

These numbers don’t indicate to me that product concentration is too much of an issue moving forward.

Even as we emerge in a post-lockdown economy, I struggle to believe that mask sales will somehow fall to zero.

Admittedly, many customers who purchased from Redbubble for the first time last year may not go on to become repeat customers, but I don’t think this argument could be made for all new customers.

There are now thousands of new customers who are likely to turn towards Redbubble in search of a new gift idea or personalised item the next time the holiday period comes around again.

What’s to like about Redbubble?

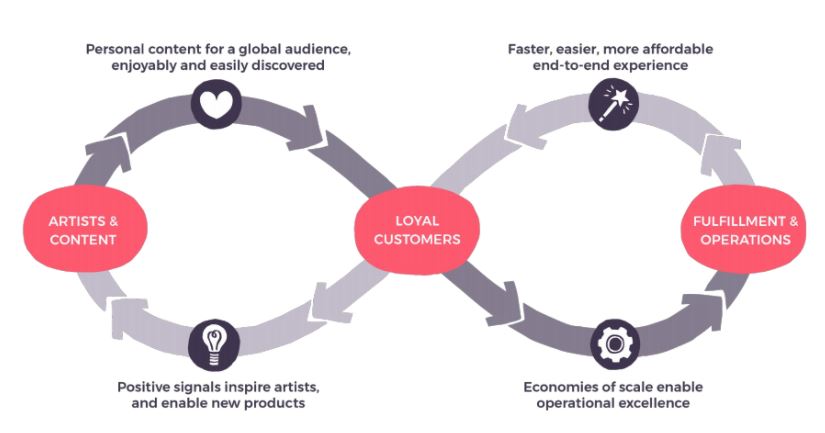

Redbubble is a highly cash-generative business that I think has the ability to compound over time thanks to its clever three-sided network business model.

As pointed out by my colleague, Raymond Jang in his article, any investment into one of the three parts of its business results in a network effect that bolsters the other aspects.

As an example, if Redbubble deploys capital towards attracting new customers, this incentivises new artists to join the platform and vice versa.

Management seems well-aligned, with CEO Michael Ilczynski recently picking up over $2 million worth of shares at an average price of around $5.53 per share.

Gauging the potential market opportunity is challenging due to the broad range of products that could potentially be listed on its platform, but management thinks its Total Addressable Market (TAM) is close to around US$300 billion.

With the FY24 target of $1.25 billion MPR, this is only around 0.42% market share, which seems reasonable in my view.

What to watch for

An investment in Redbubble doesn’t come without any risks, and there will be a few things I’ll be monitoring closely, with the most obvious being sales growth later this year compared to the pcp.

More importantly, I’ll be looking for how the company is unlocking further operating leverage by comparing its margin expansion to the rate at which operating expenses (OPEX) are also growing.

This is a trend that has actually been going on behind the scenes for quite a few years now. In the below chart, the downward sloping blue line represents a reduction in proportionate costs while the upwards sloping purple line indicates expanding EBITDA margins.

Management is a key element of the investment thesis to me, with many of its shares currently held by insiders. If there were to be significant insider selling, it would greatly reduce my conviction towards the company’s outlook.

Summary

Given the high-risk nature of Redubble, it remains a fairly small weighting in my portfolio.

However, I think if the thesis is correct concerning its ability to compound incremental cashflows back into its business, the upside appears to be significant when taking a long-term outlook.

If you are on the hunt for more ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.