The Domain Holdings Australia Ltd (ASX: DHG) share price has continued its ascent, can today’s trading update push it to greater heights?

DHG share price

Steady growth

Domain has recorded a jump of 2% in total revenue for the March quarter FY21. The company notes this is adjusted for the divestment of MyDesktop, a customer relationship management platform.

Digital revenue continues to grow as it surged by 8% for the quarter.

The company advises new residential listings have recovered quite well since the pandemic last year. Domain says it is quite optimistic about the future based on record property search volumes, open home attendance, clearance rates and new account creation at Domain Home Loans.

In terms of total costs, adjusted for divestments, this is expected to rise in the mid-single-digit range from $177.2 million for FY20.

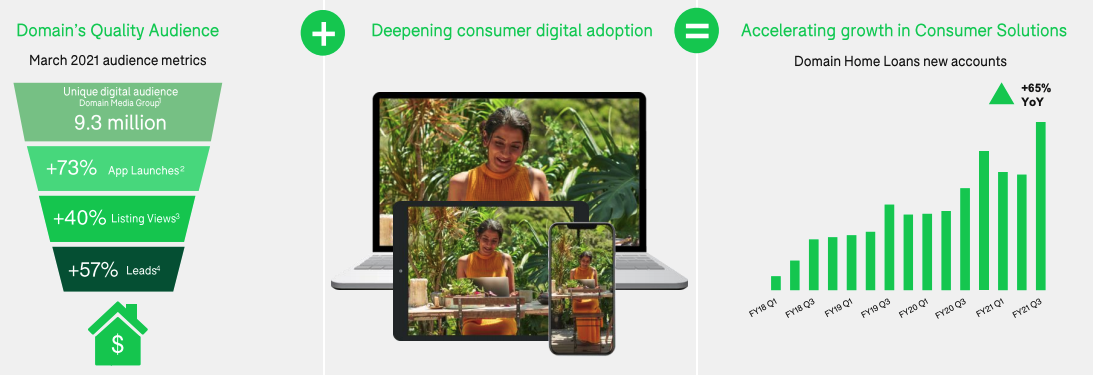

Digital adoption and consumer solutions are the way to go

Domain continues to focus on optimising its digital channel and improving its consumer solutions for future growth.

The above results provide a reflection of the pent-up demand for properties but limited supply of properties on the market.

My take on Domain

Domain is operating in a structurally growing industry as more people shift towards digital. This is something I look for as part of the Rask Investment Philosophy.

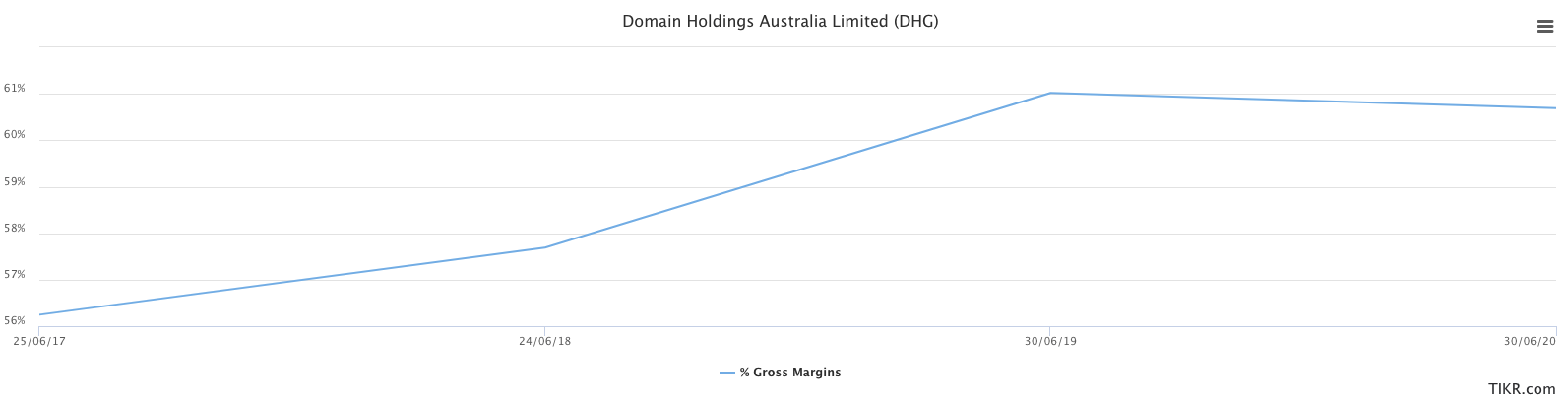

It’s easy to feel good about rising growth but it’s also important to consider the sunk costs used to generate this growth. In other words, is the growth improving the business’s underlying margins?

As you can see, gross margins have been improving, which is a great sign.

Investors should also be mindful of how Domain’s direct competitor, REA Group Limited (ASX: REA) is performing as well.

It’s evident that there is enough room for both companies to grow in the property marketplace industry. So, I would consider whether Domin’s long term strategy is value accretive.

If you are interested in other ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.