The S&P/ASX 200 (ASX: XJO) reached a 14-month high on Wednesday, adding 0.4% and once again nearing a record.

The primary driver was the healthcare sector, up 1.1%, with key constituent CSL Limited (ASX: CSL) up 2.4% offering the majority of the support.

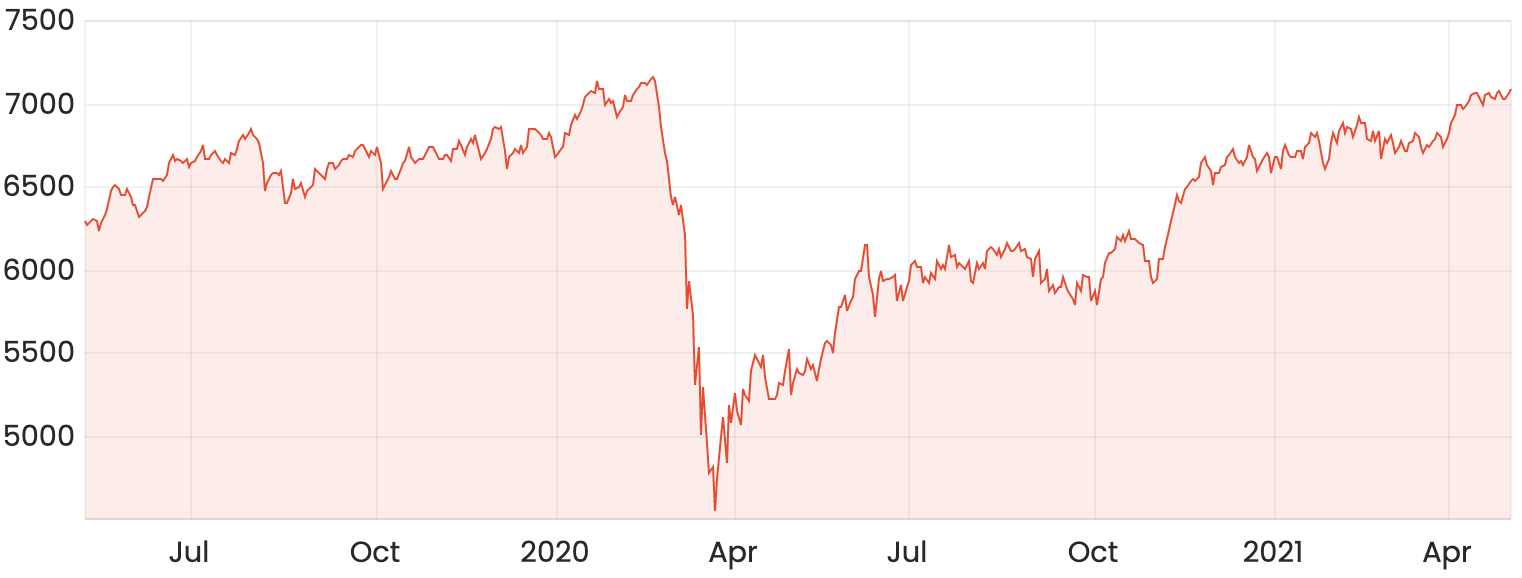

2-year ASX 200 chart

ANZ dividend surprise

By far the biggest highlight of the day was ANZ Banking Group Ltd (ASX: ANZ) finally putting investors out of their misery, delivering a 45% increase in half-year cash profit to $2.98 billion.

Most importantly, management declared a dividend of 70 cents per share, ahead of expectations and double that paid in 2020.

CEO Shayne Elliott called out Westpac Banking Corp (ASX: WBC) on their massive cost-cutting program and highlighted the risk to morale of mass layoffs but announced a 2% fall in costs for his own firm.

The pandemic-era bad debts have been further reduced with $500 million released, sending the bank’s capital ratio into a very strong position. ANZ shares finished the day 3.2% lower.

Healius core business recovering

Private hospital, imaging and COVID-19 testing firm Healius Ltd (ASX: HLS) finished flat despite reporting that its non-COVID business was recovering, with revenue increasing 5%.

The biggest drivers were an 8% increase in imaging and a 25% jump in day hospital and similar surgeries, all of which came on top of the three million COVID-19 tests processed by the group.

Mapping the future

Aerial imaging group Nearmap Ltd (ASX: NEA) had another busy day, with the share pricing leading the market, jumping 14.6% after management increased its full-year revenue guidance from $120-$128m to $128 -$132 million.

Soon after Nearmap entered a trading halt, confirming it had been issued with legal proceedings in the US but offering little in the way of the associated claims. The company remains confident in delivering 20-40% revenue growth targets from 2022 onwards.

QBE dividends to recommence

QBE Insurance Group Ltd (ASX: QBE) added 4.1% after management confirmed a dividend would be paid before the end of 2021 and would likely reflect around 65% of cash profit.

The company has performed well, with premiums increased 10%, however, the majority has come from higher costs to existing customers, up 9.8%, rather than growth in its member base.

Amcor’s resilience grows

Responsible packaging producer Amcor CDI (ASX: AMC) reported $55 million in synergies from its Bemis acquisition and has since upgraded its earnings range from 10-14% to 14-15%, a significant improvement.

Third-quarter profit was 58% higher at US$684 million, with the dividend set to be increased. Amcor shares added 2.7% on the news.

ASX 200 today

The ASX 200 is expected to edge higher when the market opens on Thursday following a mixed lead from US markets overnight. For the latest news, check out Rask Media’s US stock market report.