The Catapult Group International Ltd (ASX: CAT) share price hasn’t moved much since its recent update. What does this update mean for the Catapult share price?

CAT share price

Annual contract value and multi-solution customers rise

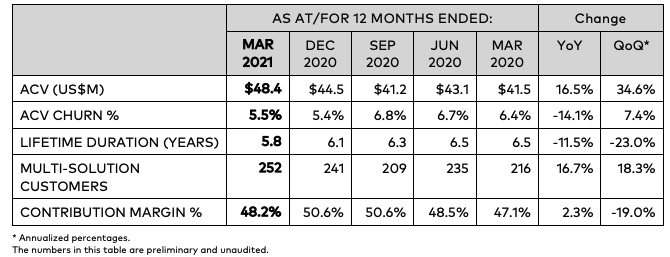

As sports across the world gradually return to play, Catapult has experienced a $3.9 million jump in Annual Contract Value (ACV) for the quarter ended March 2021 (Q3).

The growth in ACV was primarily driven by Catapult’s performance and health software solution across the Europe and Asia Pacific regions.

The North American market continues to be challenging due to the pandemic.

The growing ACV and falling lifetime duration of contracts reflect Catapult’s customers’ willingness to pay more but over a shorter contract period.

It’s encouraging to see more customers signing up for more than one solution. This remains a long runway for future growth.

However, the contribution margin % dropped slightly.

My view on Catapult

The company has produced another year of positive free cash flow with US$4.4 million and holds US$22.2 million of cash at bank as at 31 March 2021.

The continual increase in multi-solution customers indicates that Catapult’s other solutions are valuable.

It’s still early days and I think there is still a long runway for growth as Catapult has more than 3,100 professional sports teams.

Once Catapult’s platform is embedded in a sports team, it’s much easier to upsell.

Investors should also monitor its European based competitor, STATsports, which appears to be gaining traction via the mainstream social media channels.

If you are interested in other ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.