The Goodman Group (ASX: GMG) share price has recovered strongly since mid-March. Will the update for the third quarter (Q3) keep pushing the Goodman share price up?

Goodman invests, develops and manages industrial property and business space across the world. Think of warehouses, large logistics facilities (Amazon) and office parks.

Its key regions include Australia and New Zealand, Asia, Continental Europe, the UK and the Americas.

GMG share price

Location and quality drives demand

As at 31 March 2021, Goodman recorded like-for-like net property income (NPI) growth of 3.3% and occupancy was 98%.

The company notes this reflects the strong demand for Goodman’s properties.

This demand was driven by long-term supply chain requirements and tight supply in urban infill locations. Urban infill is new development on vacant or undeveloped land within an existing community.

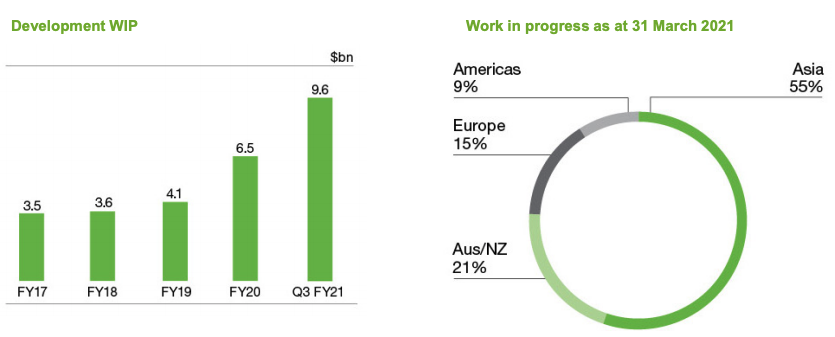

Continual growth in project work

Goodman’s development workbook has grown as the projects have increased in size and scale due to the concentration in urban locations around the world.

The company notes around 60% of its current work in progress (WIP) is now multi-storey.

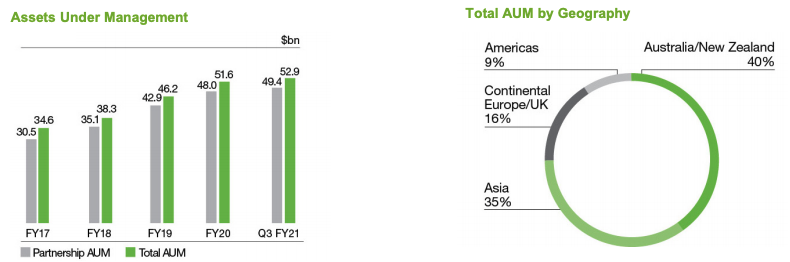

Assets under management

The value of Goodman’s properties appears to be benefiting from high occupancy and strong cash flow growth.

The total assets under management has grown to $52.9 billion.

Goodman has reaffirmed its forecast FY21 operating profit of $1.2 billion, representing earnings per share (EPS explained) growth of 12% on FY20, and a full year distribution of 30 cents per share.

My takeaway

Goodman advises its experiencing significant demand as customers respond to consumer desire for convenience. I think this shift in consumer preferences holds the key to future growth.

The CEO of Goodman, Greg Goodman said the company has focused on high barrier to entry markets where land is scarce and use is intensifying.

This resonates with the Rask Investment Philosophy in that Goodman is finding investments that have a strong competitive advantage operating in structurally growing markets.

It seems Goodman has benefited enormously from the rise in e-commerce as logistic warehouses become more prominent and I think this will likely remain for some time.

Investors should also consider the future of office spaces as more people work from home.

If you are interested in other ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.