The REA Group Limited (ASX: REA) share price has kept on rising. Can today’s third-quarter (Q3) update push the REA Group share price to record highs?

REA share price

REA Group posts a strong quarter

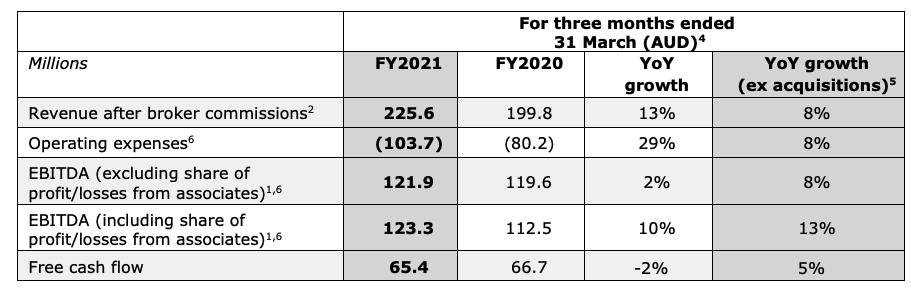

All the key financial metrics surged for Q3 FY21 compared to the prior corresponding period, being Q3 FY20.

In particular, revenue went up by 13% and earnings before interest, tax, depreciation and amortisation (EBITDA explained) jumped by 10%. EBITDA includes the share of profit/losses from associates.

The rise in revenue was driven by strong improvements in the Australian residential business and Move, Inc. Move operates realtor.com, a real estate information services marketplace in the US.

The slight drop in free cash flow was mainly attributed to the losses incurred in REA Group’s equity stake in Elara Technologies, an Indian business that provides online to offline property services.

Elara generated $9.5 million in revenue but recorded an EBITDA loss of $7.3 million due to a worsening COVID situation.

Proposed acquisition of Mortgage Choice

REA Group is excited about the opportunity to establish a mortgage broking business with increased scale, leveraging its digital expertise and significant market reach.

Subsequent to completing the mandatory regulatory and shareholder approvals, the scheme is expected to be implemented by 1 July 2021.

This will be funded by an increase in the company’s debt facilities.

REA Group continues to dominate the digital space

REA Group’s website, realestate.com.au continues to break records in terms of the number of visits. It continues to leverage its first-mover advantage in the digital space, receiving 3.2x more visits than its nearest competitor.

Also, the average monthly app launches rose by 63% on a year on year (YoY) basis, with a record 63.4 million in March.

Total app downloads of 10.8 million jumped by 10% YoY.

My thoughts

It’s evident that REA Group has benefited from improved conditions in the residential property market propped up by low-interest rates and improving consumer confidence.

As part of the Rask Investment Philosophy, I like to think about what will happen over the long term. It’s obvious that people will still buy and sell property over the long term.

Given REA Group keeps consolidating its market-leading position, there is a lot to like about the business.

Whilst it’s great to see that REA Group is exploring other avenues of revenue, investors should consider whether these endeavours are value accretive.

If you want to find out why REA Group dominates Domain Holdings Australia Ltd (ASX: DHG), click here.