Learning from the past can help build a better future. Let’s action this and zoom in on the share prices of Pro Medicus Limited (ASX: PME) and Xero Limited

(ASX: XRO).

Both Pro Medicus and Xero have performed incredibly well over the last five years but why?

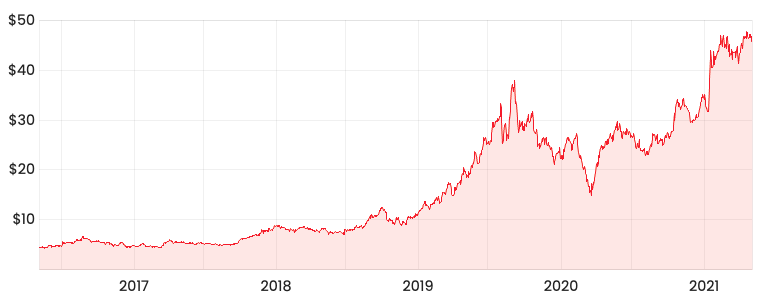

Pro Medicus share price

Pro Medicus develops and supplies healthcare imaging software and services to hospitals, diagnostic imaging groups and other health-related entities.

The company developed its key software product, Visage 7.0 that continues to be number 1 in terms of speed, functionality and scalability. It’s obvious now but what about when it was in its early stages of development?

A sound signal of the quality of a product is monitoring the reputation of its initial customers. In Pro Medicus’ case, it managed to secure contracts with a few of the biggest hospitals in the US, which can be a tell-tale sign of a high-quality product.

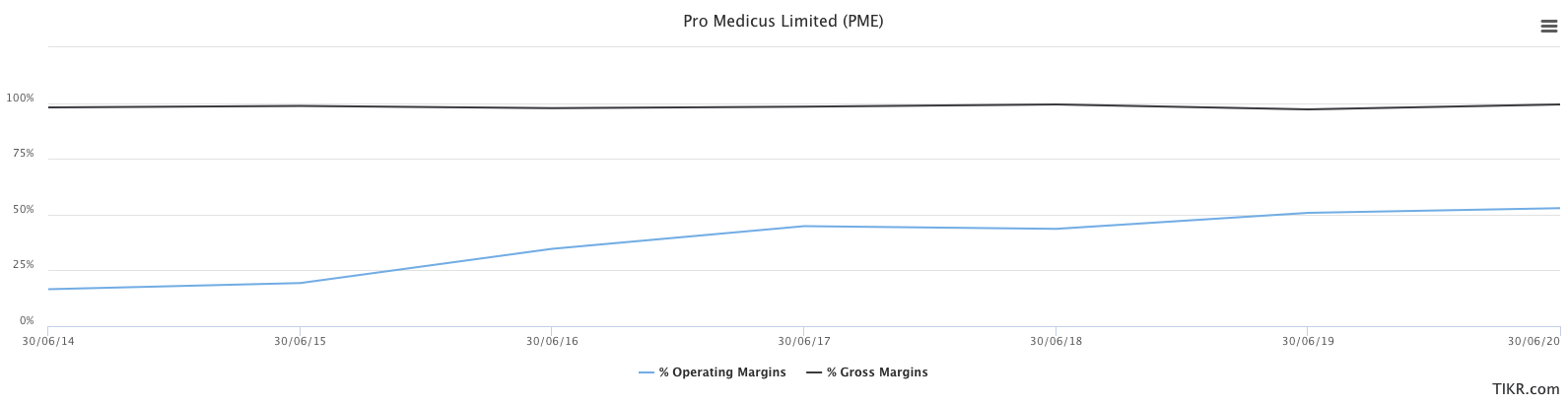

Another important driver of growth was that the software was highly scalable with high gross and operating margins.

Source: TIKR

Since the software had little marginal cost, Pro Medicus was able to rapidly grow its operating margins. This results in more free cash flow

.

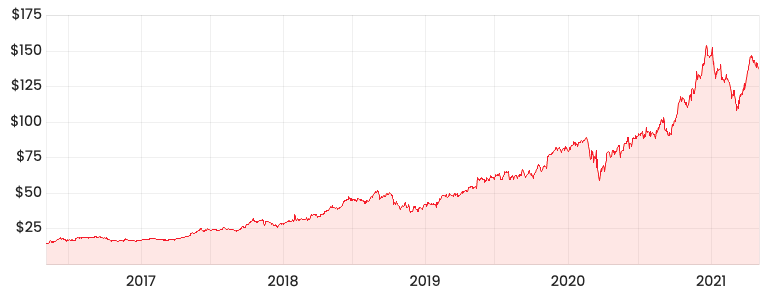

Xero share price

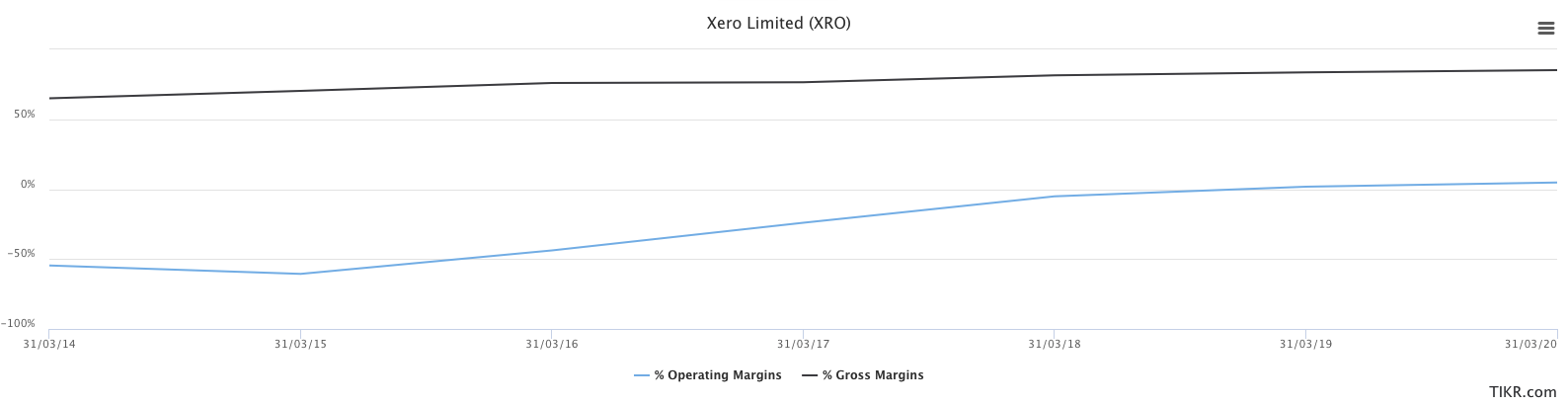

A similar story unfolded with respect to Xero.

Xero set out to disrupt the incumbent accounting platform provider, MYOB. Xero managed to develop a much better and easier to use accounting and business platform.

Talking to your personal accountant or even monitoring the recipients of major awards could have been some ways to gauge the quality of Xero. Xero was awarded as New Zealand’s Company of the Year by the NZ Hi-Tech Awards back in 2015.

It’s always easy easier in hindsight but the purpose of this piece is to learn from the past and build a better future.

Xero managed to produce a high-quality product and managed to scale rapidly due to the capital-light nature of the product offering. This is reflected by the steep rise in gross margins and operating margins.

Both businesses have been able to generate free cash flow and continue to reinvest capital into improving their existing products and solutions.

These businesses align with the Rask Investment Philosophy as they continue to operate in structurally growing industries.

These are only a couple of reasons why these businesses have done so well. If you are interested in a deeper dive into these 2 ASX growth shares, check out this podcast.