Buy-now-pay-later (BNPL) company Zip Co Ltd (ASX: Z1P) has taken a 6.7% dive today, bringing its shares below the $7 mark.

It isn’t just Zip that’s feeling the pain today though. The Australian All Technology Index (ASX: XTX) has mirrored the performance of the NASDAQ recently as we’ve seen the continual rotation out of high growth stocks into more cyclical sectors.

COVID beneficiaries from last year are among some of the hardest hit recently and include names such as Afterpay Ltd (ASX: APT), Redbubble Ltd (ASX: RBL), Kogan.com Ltd (ASX: KGN) and Temple & Webster Group Ltd (ASX: TPW).

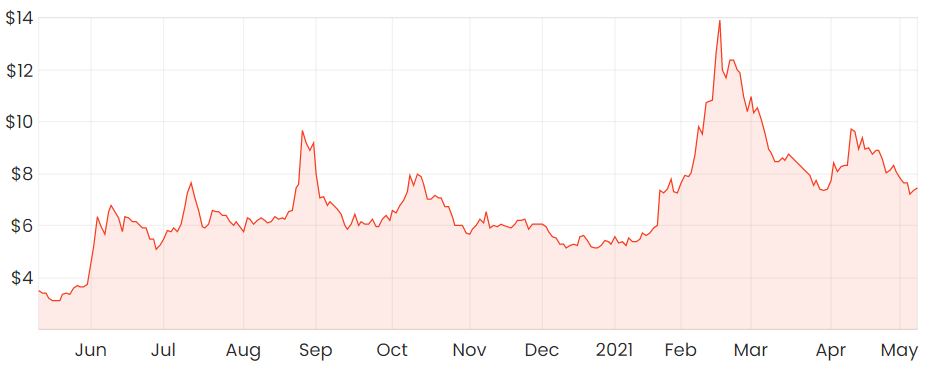

Z1P share price

How is the business travelling?

Valuation aside, Zip’s most recent quarterly update revealed to the market that the underlying business appears to still be on an upwards trajectory.

Here are a few highlights from its Q3 update.

Across the quarter, group revenue had increased to $114.4 million, up 80% on the prior corresponding period (pcp).

Quarterly transaction volume surged 114% to $1.6 billion, and Zip’s customer base had increased to 6.4 million, up 88% relative to the pcp.

Most of the growth was the result of performance from its US segment Quadpay, which experienced a jump in transaction volume to $762 million, up 234% on the pcp. Quadpay’s revenue was up 188% to $54.4 million and had 674,000 new customers join its platform.

What’s weighing in on Zip’s valuation?

Despite demonstrating strong growth of the underlying business, there are a few likely reasons why Zip’s valuation has been trending downwards recently.

The first would be fears of potential inflation and how higher interest rates could affect the profitability of leveraged companies such as Zip.

Given Zip and other BNPL’s offer interest-free instalment payments to their customers, paying higher borrowing costs for their own funding may erode into the already slim margins of some of these companies.

An additional consideration would be the rising competition in the heated BNPL sector.

Despite operating in a huge Total Addressable Market (TAM), it’s important to remember that Zip is one of many trying to tap into such a huge market. It’s worth considering how additional competitors might put further pressure on margins and how merchants may have more bargaining power over service fees in the longer term.

Offering an interest-free BNPL product doesn’t seem like a sustainable competitive advantage to me, which is why I think the future success of these companies will be partly determined by optionality and enhancements to their current product offerings.

For more share ideas, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.