Shares in Appen Limited (ASX: APX) has slumped an additional 3.4% today and aren’t far off reaching the $10 mark.

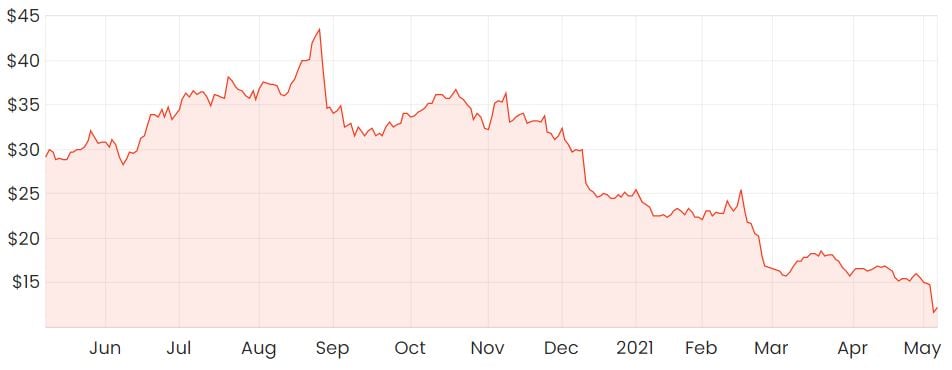

Since reaching highs of over $43 last year, Appen’s market valuation has now slumped over 73%, which has presumably caused value investors to shift their attention towards Appen’s shares in recent months.

APX share price

What else is weighing in on the Appen share price?

According to an article out of the Australian Financial Review yesterday, Appen has caused some recent controversy over a job application that asked an applicant to identify her skin colour in a range from pale white to black.

The applicant took to social media to share her experience, at which point a spokesperson for Appen reached out to apologise for the wording of the question.

According to Appen, no racism was intended from the question, although it did acknowledge that a more detailed explanation behind it was likely to be necessary.

An Appen spokeswoman said “Our goal is to help eliminate bias and make AI that works for everyone. The optional question on skin tone is used to ensure diverse datasets are included in the collection and annotation used to train computer vision algorithms.”

Appen – deep value opportunity?

Appen’s shares are undeniably cheap relative to where they once were, but without anchoring on past prices, I find it hard to get a rough sense of value. Given the uncertain outlook, I think the market has priced Appen’s shares reasonably fairly.

In my recent article on Appen, I go over both a bull and a bear case. I think a recovery of some magnitude is likely, but I don’t think the market will be willing to assign such a high multiple to Appen’s shares as it had previously.

Appen has crowdsourced its 1 million-strong workforce to perform the grunt work in the data labelling process. As of yet, it just hasn’t seen any significant scale benefits that would justify such a demanding revenue multiple typical of other tech companies in my view.

Summary

As the broader information technology sector continues to be sold off, I think there might be some further short-term pain for Appen, which is why I won’t be catching the falling knife at the moment.

For other tech share ideas, click here to read: Tech sell-off continues: These 3 ASX tech shares are worth watching.

Also, I’d highly recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.