It seems like the music has slowed down for the Humm Group Ltd (ASX: HUM) share price since COVID. Will today’s Q3 update bring back some life to the Humm share price?

Humm isn’t the only buy-now-pay-later (BNPL) company experiencing a slowdown as Afterpay Ltd (ASX: APT), Zip Co Ltd (ASX: Z1P) and Sezzle Inc (ASX: SZL) also experienced price falls.

HUM share price

BNPL up but cards segment down

Humm was previously known as FlexiGroup, which was primarily focused on providing consumer finance via cards. The BNPL segment has become its new focus.

As reported in the HY21 results, the cards business dragged down BNPL growth.

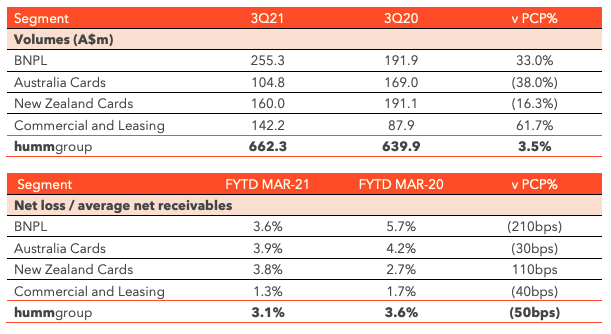

And this trend has continued as the volume of transactions processed in the cards business dropped by 26.5% for Q3 FY21, compared to the prior corresponding period, Q3 FY20 (pcp).

However, Humm posted record transaction volume for the BNPL segment, which rose by 33% on the pcp.

Humm customer and merchant numbers grow

The total customers surged by 40% to 2.7 million on the pcp. More people are downloading Humm’s app as well with 303k downloads for Q3 FY21, up from 215k for Q3 FY20.

Humm also integrated 1,111 new merchants with health and wellbeing, home improvement and retail making up a majority.

The BNPL player is set to gain more market share in the UK, focusing primarily on home improvement, health care, automotive and luxury retail.

Can Humm turn up the music?

As outlined in the article on Zip Co by my colleague, Patrick Melville, there has been a continual rotation away from growth shares to value shares. It’s a bit like musical chairs at the moment.

Given there are so many BNPL players at the moment, I think it’s important to understand how Humm differentiates itself from its competitors. What is its competitive advantage?

Afterpay is attempting to move away from the crowd by trying to add budgeting functionalities to its platform and seems to have greater optionality.

These are some of the factors that I consider when evaluating a business.

If you are on the hunt for more ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.