The GrainCorp Ltd (ASX: GNC) share price has gone from strength to strength since COVID. Today’s HY21 results may catapult the Graincorp share price.

Graincorp is a food ingredient and agribusiness company that connects growers to domestic and international consumers.

GNC share price

Strong financial results

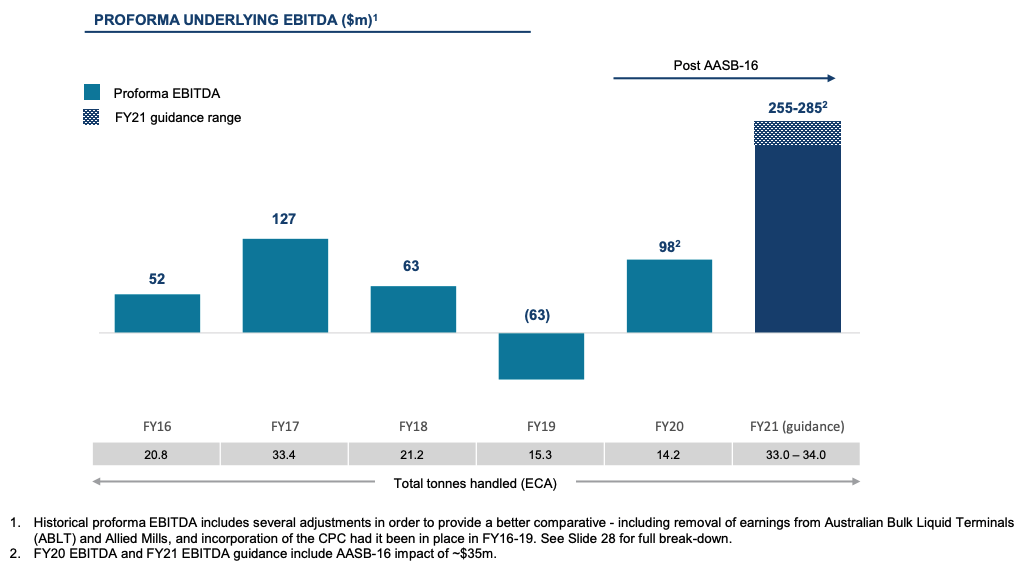

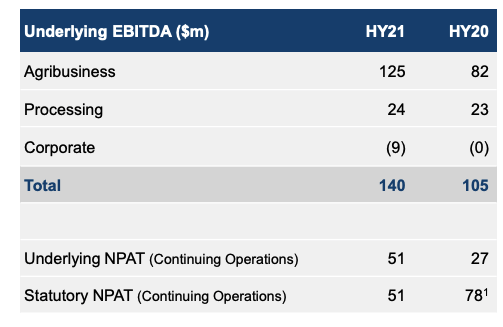

Graincorp recorded a jump of $35 million in underlying earnings before interest, tax, depreciation and amortisation (EBITDA explained

) relative to the prior corresponding period (pcp), HY20.

As a result, the agribusiness company has upgraded its FY21 guidance.

The strong performance was mainly due to the favourable turnaround in growing conditions for the 2020/21 winter crop. Production jumped by 166%.

This was boosted by solid demand for Aussie grains.

What now for Graincorp?

Graincorp benefited significantly from better conditions, enabling it to grow more crop. Weather conditions tend to be cyclical, just like the Graincorp share price.

Whilst it’s encouraging to see that demand for grains is trending upwards, I prefer to stick to businesses that are less influenced by external forces.

If you are interested in another business that operates in the agricultural industry, you can check out Patrick Melville’s article on Elders Ltd (ASX: ELD).

Otherwise, you can find more ASX growth shares by getting a Rask account and accessing our full stock reports. Click this link to join for free.