High expectations and inflation fears have caused many investors to hit the sell button and rotate into value sectors such as industrials, financials and utilities companies.

I think these three ASX growth shares are worth watching closely.

Xero

Yesterday, Xero Limited (ASX: XRO) released its FY21 results to the market, which sent shares down around 10% on the day.

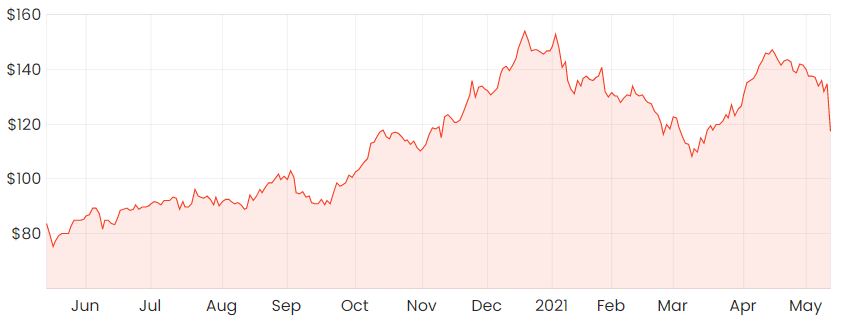

XRO share price

While it did report continued growth across the business, it’s important to remember that Xero’s shares are priced at around 21x sales, which implies there’s a fair amount a lot of optimism priced into its valuation.

Xero had gained 456,000 subscribers across the year, but revenue had only increased 18% and average revenue per year (ARPU) had actually fallen slightly.

As my colleague, Raymond Jang explains in his recent article on Xero, there are a few other important metrics to keep your eyes on moving forward, including its customer acquisition costs (CAC) as a proportion of revenue, which have been falling over the past few years.

Xero’s international expansion appears to be progressing steadily, albeit perhaps not quite as fast as some were hoping. Revenue growth in the UK and the US came in at 22% and 2%, respectively.

Management told the market the drop in revenue growth was due to bundling Hubdoc within the Xero business edition in March 2020.

Xero reckons that internationally, there’s still only a 20% adoption rate for potential cloud-based accounting users. Given its lofty revenue multiple and high expectations, the continued expansion into new markets will be key for Xero’s share price moving forward.

Xero’s shares are trading 3% lower today at $113 per share.

Redbubble

Ever since Redbubble Ltd (ASX: RBL) released its Q3 trading update to the market last month, its shares have been a constant falling knife.

RBL share price

The current sentiment around Redbubble’s shares isn’t great at the moment. In the short-term, the day-to-day price movements of its share price are pretty much identical to shares of US-based Etsy Inc (NASDAQ: ETSY).

As a long-term investor, I think there’s little point in observing day-to-day price movements that are mostly sentiment-driven.

Fundamental performance will be the most important thing in the long run, so I’ll be monitoring other aspects such as website traffic, marketing costs as a proportion of revenue, artist retention and seeing how this is being reflected in its top-line growth.

Due to my long investment horizon, I’m not concerned that the business isn’t aiming to generate a profit within the next few years. In fact, for a high growth company, this is what I would’ve preferred and expected.

Redbubble has an attractive business model, a compelling product offering and an aligned management team with a vision to grow the company to new heights over the coming years.

If you’d like to read more about the bull case for Redbubble’s shares, click here to read: Why I think Redbubble (ASX: RBL) shares are now in the buy zone.

Kogan

I think another ASX growth share worthy of your watchlist is Kogan.com Ltd (ASX: KGN). Its shares have fallen from over $25 to $10 since October last year.

KGN share price

Kogan’s shares have recently suffered the same fate as Redbubble’s. Kogan saw rapid growth rates from the onset of COVID-19 which haven’t been able to be sustained coming out of the busy holiday period and into Q3.

I think it’s a possibility that investors may have high expectations from retailers over the next year at least, so they might struggle despite releasing pleasing results to the market.

While some could argue new customers of Kogan may have made a once-off purchase since the onset of the pandemic, I would argue that an influx of new customers could’ve actually given the company a sustainable tailwind and a slight first-mover advantage over new entrants.

With so many new customers now familiar with transacting with Kogan, this could encourage repeat sales in the future. A key metric to monitor would be Kogan’s customer acquisition costs (CAC) which would likely fall if customers make repeat purchases.

Something else that’s important to watch will be the product split between third-party products and private label. The latter sells on a higher gross margin and gives a reason for customers to shop with Kogan.

If more customers are drawn towards third-party items, it doesn’t seem like a sustainable competitive advantage if customers are able to shop for the same product elsewhere.

For more reading on Kogan shares, click here to read: Is it finally time to invest in Kogan (ASX: KGN).

If you’re on the hunt for other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.