It appears the Whitehaven Coal Ltd

(ASX: WHC) share price has bounced back as it surged by 9% today. What’s happening with the Whitehaven share price?

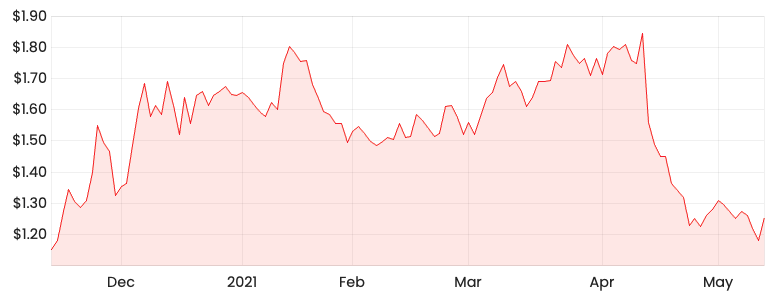

WHC share price

Whitehaven Coal is Australia’s leading producer of premium thermal and metallurgical coal. This coal is used to generate electricity, make steel, and in nickel smelting.

It has mines in New South Wales and Queensland, exporting coal products to Asia, mainly Japan and Korea.

Macquarie upgrade

Whitehaven has benefited from an upgraded rating from Macquarie with a price target of $1.70 per share.

Macquarie believes Whitehaven will benefit from the increase in thermal coal prices.

The broker’s earnings forecasts have been bumped up by 130% and 290% for FY22 and FY23 based on the current market thermal coal prices.

My thoughts on Whitehaven

The share price of Whitehaven has jumped mainly due to the upgraded rating provided by Macquarie. This often generates short term momentum.

As part of Rask Investment Philosophy

, I prefer to take a long term outlook when considering investment opportunities.

Given Whitehaven coal operates in a structurally declining industry due to the rising adoption of renewable sources of energy, I think it will be hard for Whitehaven to continue to grow over the long term.

If you are interested in other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.