The Xero Limited (ASX: XRO) share price has dropped by as much as 10% after releasing its FY21 results. Here’s my view on the results and future of the Xero share price.

It seems Mr Market was expecting more from ASX growth shares with Afterpay Ltd (ASX: APT) and Altium Limited (ASX: ALU) falling out of favour as well.

XRO share price

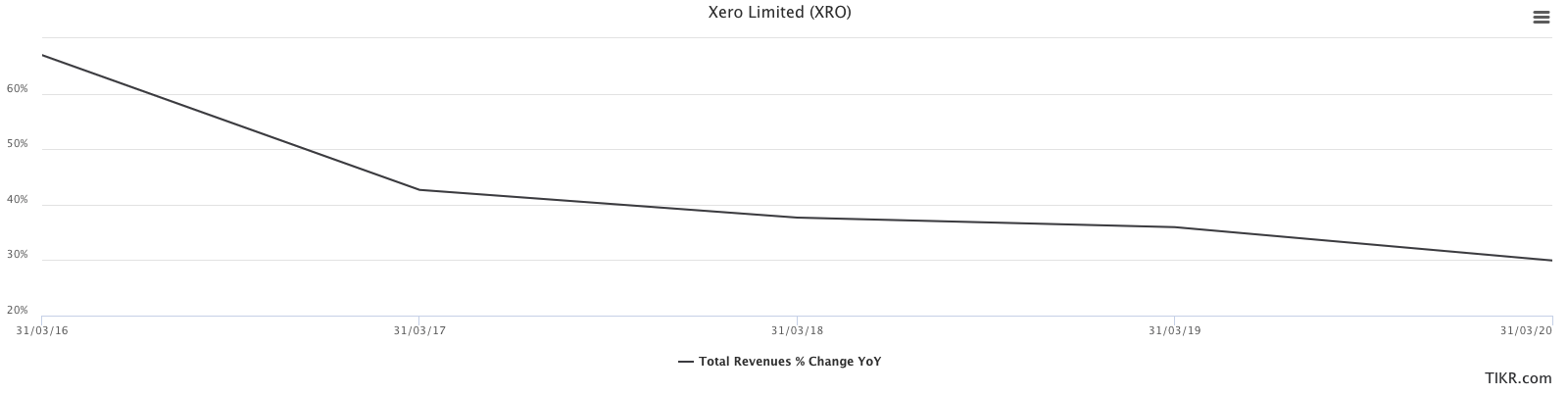

Slowdown in growth

It appears Xero is suffering a similar fate as the other ASX growth shares for a slowdown in revenue growth. This has become a growing trend in the last few months as investors turn to value plays.

As seen below, the revenue growth rate has decelerated substantially to 18% for FY21 on a year-on-year basis.

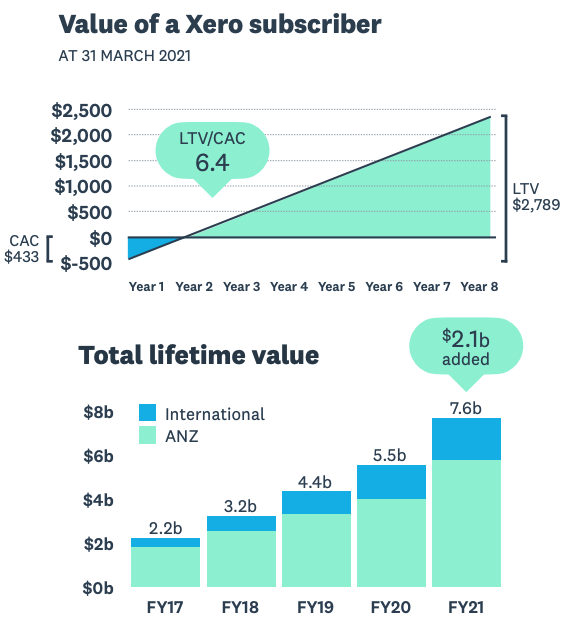

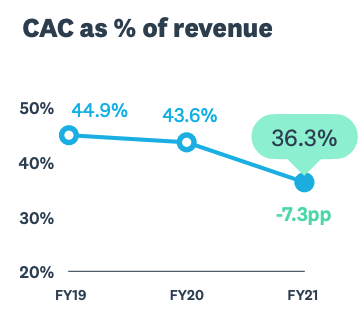

Unit economics still attractive

Even though revenue growth has slowed down, the unit economics of the Xero business is getting stronger. What do I mean by its unit economics?

So, each Xero customer or subscriber is generating more value and it is spending less money on sales and marketing costs to acquire customers.

As you can see below, the customer acquisition cost as a percentage of revenue is declining.

Some metrics to keep an eye on

Whilst gross margins and the lifetime value per subscriber has increased, average revenue per user actually declined.

Xero notes this was mainly due to the impact of the Hubdoc bundling in North America as a majority of Hubdoc subscribers were based in this region.

Another metric I will be monitoring is the level of expenditure on product investment, which went up by 38% compared to last financial year.

How far can Xero fly?

It’s encouraging to see Xero continuing to generate strong growth in free cash flow, which provides the business with a lot of optionality.

However, with Xero being currently price at around 21x sales (Price to Sales ratio) and revenue is growing at 20%, I would consider where and how Xero is going to generate more organic growth.

This is a high-level multiple and should only be used as a comparative measure when evaluating other potential investments. Here is an explanation of SaaS valuation multiples.

A sound method of determining the value of Xero may be to compare it to either similar businesses or businesses with similar business models like Intuit Inc. (NASDAQ: INTU) and Salesforce.com, inc. (NYSE: CRM).

If you are on the hunt for more ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.