The Elders Ltd (ASX: ELD) share price has dipped slightly upon the release of its HY21 results. What do the results mean for the Elders share price?

Elders is an Australian agribusiness that provides agricultural goods and services to primary producers in Australia and New Zealand.

ELD share price

Everything up except for cashflow

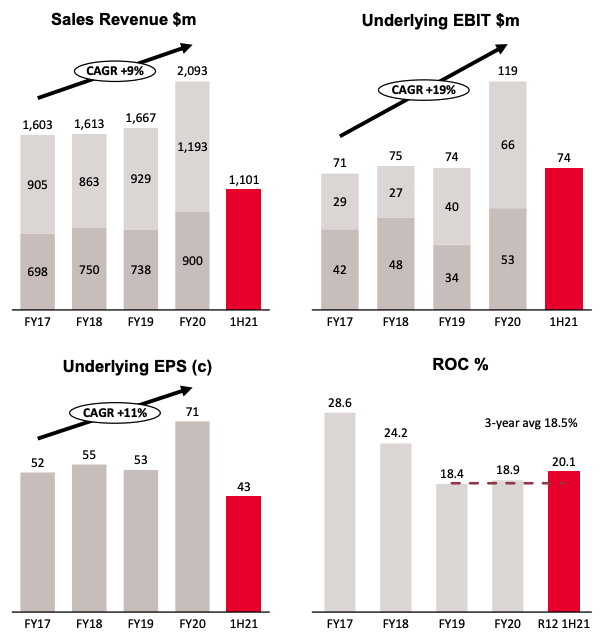

Elders recorded strong financial results as revenue and net profit after tax jumped by 22% and 31% respectively compared to the prior corresponding period (pcp), being the half-year for FY20.

In terms of the company’s underlying earnings before interest, tax, depreciation and amortisation (EBITDA explained), this also jumped by 28% for the same period.

However, Elders’ operating cash flow dropped by 13% over the pcp.

The decline in operating cash flow was mainly driven by a higher level of cattle inventory.

Elders to pay an interim dividend

The company paid a final dividend of $0.13 per share for the period ended 30 September 2020.

Elders will pay an interim dividend of $0.20 per share for the HY21, 20% franked. This equates to a payout ratio of 45.8% of net profit after tax.

My takeaway

Whilst the agribusiness generates attractive top-line numbers, I do have some concerns regarding the decline in operating cash flow.

As part of the Rask Investment Philosophy, I try and focus on businesses that have solid gross margins, enabling higher free cash flow.

Given the highly capital intensive nature of Elders’ business, gross margins have remained between 19% to 21%, which is quite low.

In saying this, Elders could be a sound dividend ASX share as it continues to lift its dividend payouts.