The Nuix Ltd (ASX: NXL) share price took a surprise turn as it shot up this morning by as much as 10%. So, why did the Nuix share price go up all of a sudden?

As covered by my colleague, Lachlan Buur-Jensen, Nuix suffered a significant tumble yesterday on the back of negative news.

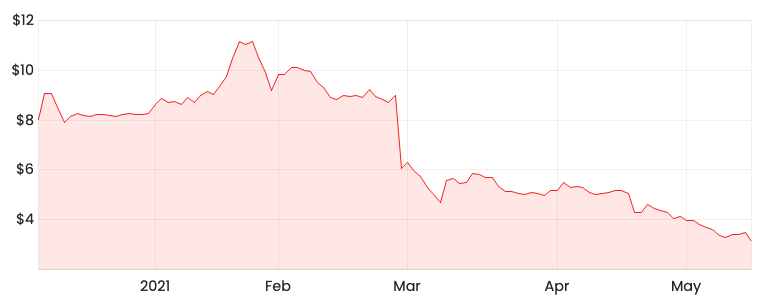

NXL share price

Nuix CEO apologises

It appears Mr Market is slowly forgiving Nuix for the subpar performance and shenanigans reported by major news publishers in recent months as the Nuix CEO, Rod Vawdrey apologised to investors.

Vawdrey said he takes full responsibility for the recent performance of the business and promised to better communicate to shareholders.

Nuix chairman, Jeff Bleich also flagged that the company failed to develop internal structures to develop strong investor relations. Bleich said it wasn’t fully equipped and prepared to deal with the attention that has come with being listed.

Can Nuix keep its promise?

Actions often speak louder than words. Given a lot of negative news has come out, I would monitor the actions and behaviour of management over the next six months.

This is important to evaluate in light of issues concerning the culture and alleged assertion from six senior executives that the company had, “lost focus, lost customer-centricity and stopped innovating” in 2019.

Culture can be monitored through employee reviews, the level of employee headcount and notable resignations with a high level of seniority.

Customer satisfaction can be tracked by considering the level of churn and product reviews. As for innovation, the financial statements can provide an illustration of how much capital is being deployed in research and development.

I would focus on these key issues to determine whether Nuix aligns with the Rask Investment Philosophy over the long term.

If you are interested in other ASX growth ideas, I suggest signing up for a free Rask account and accessing our full stock reports.