The Redbubble Ltd (ASX: RBL) share price has fallen by as much as 5% today. Let’s take a further look at the Redbubble share price.

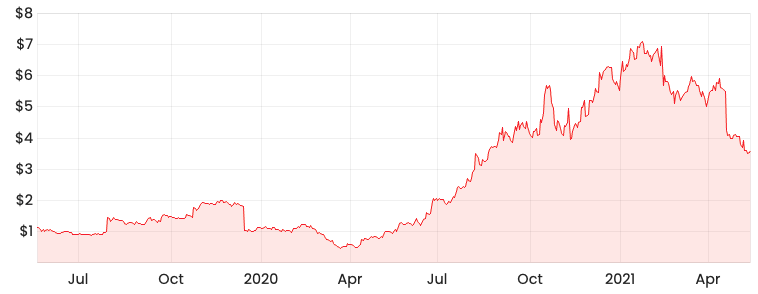

RBL share price

Is Redbubble a one-trick pony?

Redbubble was all the rage as it capitalised on the surge in demand for bespoke items like masks, shirts and artwork due to the pandemic.

There are concerns over Redbubble’s ability to convert one-off customers into repeat customers.

These concerns are justified given Redbubble recorded a slowdown of marketplace revenue of around 50% on the prior quarter to $103.4 million.

Investors were also put off by the significant marketing spending, which rose by 71%. So, it’s understandable that Mr Market is worried.

In saying this, investors should be reminded that Redbubble’s operations are seasonal in nature and tend to drop after Christmas.

Can Redbubble recover?

Whilst numbers can tell you what’s happened in the past, I think human behaviour has the potential to provide small insights into the future.

Redbubble received the catalyst it needed to gain attention from the world, which was an inflection point for the online marketplace.

Considering Redbubble has built strong momentum in exposing its brand to so many new customers since the pandemic, it’s important to ensure customer awareness remains intact and gets even stronger. So, from this perspective, I think it makes sense that Redbubble is deploying more capital towards marketing and amplifying its artist seller and buyer network.

Also, Redbubble does not necessarily need to be the dominant marketplace because sellers are incentivised to use as many platforms as possible to optimise their sale opportunities.

I think there is still a long runway for growth but capital expenditures should be monitored closely alongside web traffic levels and social media presence.