With the onset of COVID-19 and the imposition of tariffs by China, the Treasury Wine Estates Ltd (ASX: TWE) share price has fallen 35% since January 2020.

Here, I present the bull case for the company and why it may not all be negative.

Who is Treasury Wine Estates?

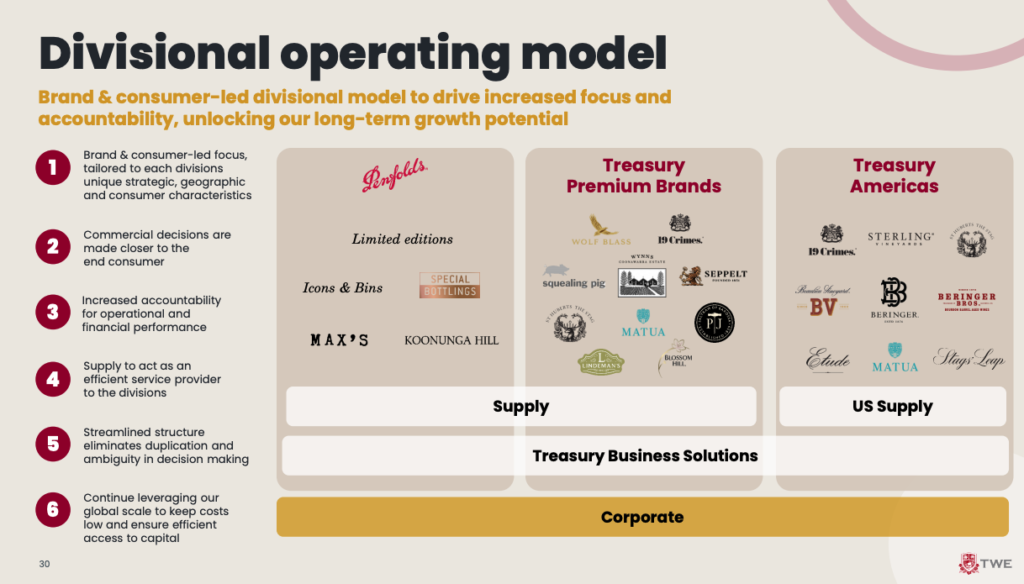

Many readers will be familiar with one or more of the many brands within the Treasury Wines portfolio. Some notable names include Penfolds, Wolf Blass, 19 Crimes, Matua and Lindeman’s.

The company sells its wine in over 70 countries, operates 128 vineyards, and harvests over 12,000 hectares of grapes.

China – a glass of half-full scenario?

In March, China’s Ministry of Commerce (MOFCOM) finalised anti-dumping tariffs of 175.6% on Australian country of origin wine under two litres, effectively ending Treasury Wine’s sales in the region.

The Chinese market was a significant growth driver for Treasury Wine shares, with margins of over 40% and double-digit sales growth.

However, an optimist may view the tariffs as a blessing in disguise. $500 million worth of inventory previously reserved for China is now available to be reallocated to underserved markets. Moreover, the business may opt to enter new markets such as India where there is unmet demand.

This will give Treasury Wine a headstart on its American and French competitors. Furthermore, it will diversify away from the regulatory and geopolitical risks of China.

The jewel in the crown revealed

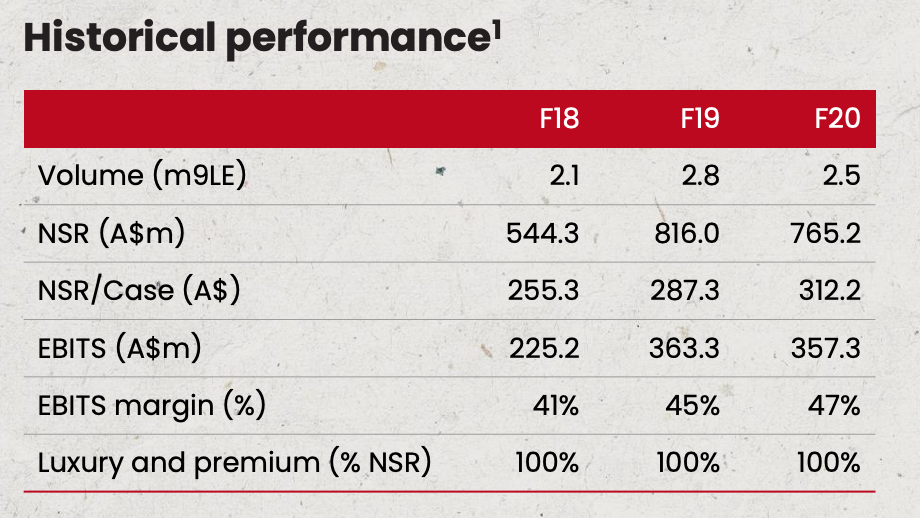

By restructuring internal reporting segments, investors are able to see for the first time the true financial might of Penfolds.

Volume slowed in FY20, primarily due to the effects of COVID-19. Sales volumes reduced as bars, restaurants, and cellar doors were forced to close. As a result, Net Selling Revenue (NSR) also fell.

A better indicator of Penfold’s strength is NSR/Case. In simple terms, this is the average selling price for a case (six bottles) of Penfolds. Despite demand falling in FY20, the average price per case increased 22% from 2018 to 2020 illustrating high pricing power.

Earnings before interest, tax, and SGARA (EBITS) increased 58% from 2018 to 2020 demonstrating as sales grow, more income falls to the profit line. As a result, the EBITS margin increased 6 basis points to 47%.

SGARA is an accounting vernacular for revisions in the difference between the fair value of grapes and the cost to plant those grapes.

Evident by the NSR/Case and EBITS margin, Penfolds demonstrates a brand moat similar to the likes of Chandon or Veuve.

Refocus on premium brands

The internal restructure to split Penfolds into a stand-alone operating segment opens the opportunity for dedicated sales and marketing teams for the Treasury Premium Brands and Treasury Americas portfolios.

Sales and marketing staff were previously shared among all brands. As Penfolds is the highest margin brand within the portfolio, it took the lion’s share of resources.

Management noted there will be increased costs as a result of dedicated marketing divisions. These costs will be offset in other areas of the business.

Attractive valuation

With a market capitalisation of approximately $8 billion, this values Treasury Wine at 22x Penfolds EBITS.

Given Penfold’s opportunities abroad and brand strength, this valuation is undemanding. In the United States, market brand awareness is 10%. The United Kingdom is 30% and in Asia ex-China awareness ranges from 10-50. Furthermore, investors would be receiving the 128 vineyards, Treasury Premium brands and Treasury Americas portfolios for free.

This is a back of napkin calculation, failing to account for taxes, interest, or capital expenditure. However, the valuation is compelling.

Another possibility is that a competitor or private equity outfit makes a bid for Penfolds, now that it is a stand-alone division within Treasury Wines.

Summary thoughts

The asset-backing of the vineyards in addition to the brand strength of Penfolds provides a floor on the Treasury Wines share price. If it continues to drift lower, it will likely be bid for by a bigger player.

If management can execute on growing the portfolio ex-China, I think today offers an attractive entry price.

Stay tuned for the upcoming bear the case for Treasury Wines, where I will outline the downside risks facing the business.

If you are interested in other ASX growth ideas, I suggest signing up for a free Rask account and accessing our full stock reports.